|

Buttonwood Agreement

- May 1792

(http://memory.loc.gov/pnp/gsc/5a12000/5a12000/5a12096r.jpg)

Buttonwood Agreement

- May 1792

(http://memory.loc.gov/pnp/gsc/5a12000/5a12000/5a12096r.jpg)

1602

- Shares of Dutch East India Company (Vereenigde Oost-Indische

Compagnie - V.O.C.) began trading on Amsterdam stock exchange

(States-General of the Netherlands sponsored creation of single

"United East Indies Company", granted 21-year monopoly over

Asian trade; empowered to build forts, maintain armies, conclude

treaties with Asian rulers; financial accounting only at end of

each decade); first multinational corporation in world, first

company to issue stock; beginning of trading in global equities.

1609

- Isaac le Maire, 8 others founded Grote

Compagnie, secret company to trade in shares of

Vereenigde Oost-Indische Compagnie, company with monopoly patent

on trade via Cape of Good Hope, Strait of Magellan, only known

routes to Indies; sold VOC shares short = original short-seller

(Le Maire had been merchant for the

Vereenigde Oostindische Compagnie, became largest shareholder in

1602 when all Dutch trading companies merged into VOC; forced

out in 1605 over rumors that he did not submit receipts to share

costs); 1610

- States-General of the Netherlands prohibited short sales of

VOC stock; 1610-1611

- VOC stock rose about 200%; Le Maire suffered big losses; many

members of his company went bankrupt; Le Maire left Amsterdam;

1614 - founded

Austraalse Compagnie to discover passage from Atlantic to

Pacific Ocean (outside VOC trading monopoly); discovered passage

around Cape Horn, ships confiscated in breach of VOC patent;

1619 - court ruled

ship unlawfully seized; 1621

- Dutch West India Company established, awarded monopoly patent

on travels through Strait of Magellan, other routes region

(contrary to rights granted to Austraalse Compagni);

1622 -Le Maire

published his son's discoveries; court ruled that Austraalse

Compagnie not allowed to trade in Indian region, did have right

to travel across newly discovered route around Cape Horn;

1644 - decision

upheld.

Isaac le Maire

- first short-seller

Isaac le Maire

- first short-seller

(http://www.christenhistorici.nl/photoshow.php?id=804&type=thumb)

May 17, 1792

- Twenty-four traders gathered under

buttonwood tree at 68 Wall Street in lower Manhattan to set

conditions, regulations of speculative market (Peter

Anspach, Armstrong & Barnewall, Andrew D. Barclay, Samuel Beebe,

G. N. Bleecker, Leonard Bleecker, John Bush, John Ferrers,

Isaac M. Gomez, John A. Hardenbrook, Bernard Hart, Ephraim Hart,

John Henry, Augustine H. Lawrence, Samuel March, Charles McEvers

Jr., Julian McEvers, David Reedy, Robinson & Hartshorne,

Benjamin Seixas, Hugh Smith, Sutton & Hardy, Benjamin

Winthrop, Alexander Zuntz); resulted in

Buttonwood Agreement - two-sentence contract gave

birth, in 1817, to New York Stock & Exchange Board (renamed New

York Stock Exchange in 1863); established stricter rules,

parameters to more effectively govern trading (previously

speculators had conducted auctions twice a day in various

locations, including street corners and coffeehouses); Bank of

New York - first corporate stock traded.

March 3, 1801 -

"The Stock Exchange" in London (known since 1773 as "New

Jonathan's", dealing room on ground floor and coffee room above

in building in Sweeting's Alley) reopened under formal

membership subscription basis; first regulated exchange in

London, birth of modern Stock Exchange.

1817

- Brokers formalized arrangement, created New York Stock &

Exchange Board with rented rooms on Wall Street; constitution

specified appropriate business conduct.

March 16, 1830

- New York Stock Exchange slowest day ever (31 shares traded).

October 25, 1861

- Toronto Stock Exchange created.

September 11, 1862 - Forty members organized

San Francisco Stock and Exchange Board (adopted by-laws, elected

officers) as marketplace for mining company stocks after

Comstock Lode strike, first mining exchange; rented room in

Montgomery Block; J. B. E. Cavallier President.

January 4,

1865

- New York Stock Exchange (NYSE) opened first

Corinthian-style structure permanent headquarters at

10-12 Broad near Wall Street in New York City;

1903 - more spacious quarters opened at 18 Broad

Street; trading floor still used today.

December 9, 1865 - New York Stock Exchange

opened in new home at 10-12 Broad Street in lower

Manhattan.

November 15, 1867

- First stock 'ticker' unveiled (name of sound its type wheel

made); idea of Edward A. Calahan, of Gold & Stock Telegraph

Company (configured telegraph machine to print stock quotes on

streams of paper tape); March 31,

1868 - Calahan received a patent for an

"Improvement in Telegraph Indicators" ("for the prices of gold,

stocks, etc....consists of a transmitting-instrument formed as a

disk, upon which are marked the signals, numbers or words to be

pointed out"); April 21, 1868

- received second patent or an "Improvement in

Printing-Telegraphs" ("for Registering Gold, Stocks,

etc....intended to accomplish...a correct record of various

fluctuations in the price of gold, stocks, and articles of

trade, and to have these fluctuations simultaneously and

periodically denoted and registered at the various centers of

business connecting with one central transmitting station");

assigned to Gold & Stock Telegraph Company;

November 9, 1869 -

Thomas Edison received patent for an "Electrical Printing

Instrument" ("Improvement in Printing-Telegraph Apparatus");

easier-to-use version of Calahan's ticker, Edison's first

lucrative invention; eventually replaced by computerized tickers

with electronic displays.

1868 - Membership on NYSE held as valuable

property; seats limited to 1,366; new members must buy

seats from existing members.

October 23, 1869

- New York Stock Exchange put memberships up for sale

for first time in seventy-seven-year history.

November 1, 1871

- NYSE passed stern law forbidding members from "dealing

with" non-members in "rooms of Exchange;" punishment

for infraction was suspension lasting

anywhere from sixty days to one year.

June 4, 1875 - Pacific Stock

Exchange opened.

May 15,

1878 - Tokyo Stock Exchange formed; first public

trading institution in Japan;

April 1, 1949 - Tokyo Stock Exchange, in current

form, founded; January 31, 2007

- TSE, NYSE agreed on alliance on technology, investment

products, more.

November

13, 1879 - New York Stock Exchange installed

telegraph, phone lines.

September 18, 1882

- 19 brokers signed charter, deposited $50 each,

organized Local Security Board to trade in stocks and

bonds of corporations other than mining shares; John

Perry, Jr., President; October 2, 1882 -

renamed San

Francisco Stock and Bond Exchange; March 1883

- daily list of quotations, transactions first printed;

September 1, 1883 - total business in

first year $9,490,621; January 2, 1957 -

merged with Los Angeles Oil Exchange (organized December

1899), renamed Pacific Stock Exchange;

1973

- renamed Pacific Stock Exchange; 1997 -

renamed Pacific Exchange; May 26, 2001

- trading floor closed, transferred to electronic

format, Archipelago Exchange; September 27, 2005

- acquired by Archipelago Holdings for $40 million,

10.8% equity stake.

December 15, 1886

- Record 1.2 million shares changed hands in frantic

trading.

May 26, 1896

- Charles Dow first published Dow Jones Industrial

Average of dozen 'smokestack' company stocks: American

Cotton Oil, American Sugar, American Tobacco, Chicago

Gas, Distilling & Cattle Feeding, General Electric,

Laclede Gas, National Lead, North American (utility),

Tennessee Coal & Iron, U.S. Leather (preferred), U. S.

Rubber; 1884 - Charles Dow's initial stock

average contained 11 stocks (9 railroad stocks) appeared

in "Customers' Afternoon Letter", daily, 2-page

financial news bulletin (precursor of the Wall Street

Journal); October 4, 1916 - list of 20

industrial stocks (all common shares) replaced previous

list of 12; October 1, 1928 - Dow Jones

Industrial Average 30 began, expanded from 20 to 30

stocks; divisor (16.67) introduced to adjust for effects

of stock splits, stock distributions, stock

substitutions.

October 7, 1896

- Dow Jones began reporting average of prices of

12 industrial stocks in Wall Street Journal.

May 28, 1897

- Dow Jones Industrial Average (12 stocks) moved up for

14 trading days in row (through June 14); total gain

of 3.75 points, 9.56%, closed at 42.96; longest streak

in history.

(http://external.globalfinance.net/Charts/DJIA_1900_2009.jpg)

March 29, 1900

- Louis Jean-Baptiste Alphonse

Bachelier, French mathematician, published

'Theorie de La Speculation'; argued that

markets were essentially random (could not be forecast

accurately); father of financial

mathematics.

Louis

Jean-Baptiste Alphonse Bachelier

- Randomness

(http://www.gap-system.org/~history/Thumbnails/Bachelier.jpg)

Louis

Jean-Baptiste Alphonse Bachelier

- Randomness

(http://www.gap-system.org/~history/Thumbnails/Bachelier.jpg)

September 9, 1901

- Workers laid cornerstone for new NYSE building

at 18 Broad Street; 1903

- building completed (still open today); new quarters included trading floor over

twice size of predecessor.

November 9, 1903

- Panic of 1903 reached nadir--Dow dropped to 42.15

as stocks of industrial companies plunged to

single-digit lows; known as "Rich Man's Panic"; fiscal crisis dragged on for rest of year,

took severe toll on banks, steel and

iron producers.

1904

- National Quotation Bureau began as paper-based,

inter-dealer quotation service; linked competing market

makers in OTC securities across country; Pink Sheets, Yellow Sheets - central resource for trading

information in OTC stocks and bonds.

January 12, 1906

- Dow

Jones Average closed above 100 for first time.

1908 - American Stock Exchange traced roots

to traders officially organized as New York

Curb Agency; 1921

- moved indoors.

July 31,

1914 - Treasury Secretary William McAdoo closed

New York Stock Exchange; protected stock of gold in U.S., gave

young Federal Reserve System chance to get organized (opened on

November 16, 1914); set foundation for shift away from pound

sterling to dollar as international reserve currency after World

War I; concerned that sellers, mainly British and French, would

convert dollar proceeds to gold, ship it to Europe to finance

war efforts, effectively wipe out U.S. gold stock (young Federal

Reserve would have nothing to back its note issue, diminish its

credibility as central bank); insisted that U.S. remain on gold

standard while everybody else but England was going off of it;

signaled that U.S. determined to honor its foreign debt, prevent

massive devaluation of dollar; set foundation for shift away

from pound sterling to dollar as international reserve currency

after World War I (contrast with popular belief that Governing

Board of NYSE initiated closure of exchange in face of massive

sell-off in shares to protect share prices).

November

28, 1914 - New York Stock Exchange, closed since

July, re-opened for bond trading with set of restrictions

designed to keep markets from crumbling during war.

December 1, 1914

- San Francisco Stock & Bond Exchange became first U.S. exchange to re-open after nation's

markets temporarily shut down to safeguard against debilitating bear run with outbreak of World War

I.

December 12, 1914

- Dow Jones Industrial Average suffered worst percentage drop in history (since first published

in 1896) - 24.39% - on first day of trading

in more than four months (New York Stock Exchange

had shut down when World War I began in July); DJIA

dropped 40% late 1916 to early 1917.

December 15, 1914

- NYSE re-opened with tight set of trading restrictions

designed to prevent fiscal disaster.

November 29, 1918

- New York Stock Exchange Building Co. acquired

nearby Mortimer Building (fifteen years after NYSE moved

into new offices at 18 Broad Street); 1922

- Exchange opened new offices in

twenty-three-story tower, featured extra trading space,

dubbed the "garage."

January 2, 1919

- New York Stock Exchange installed separate

ticker to track bond trading.

October 2, 1922

- New York Stock Exchange opened new offices,

eleven-story building at 11 Wall Street.

1923 -

Standard and Poor's developed first stock market indicators;

covered 26 industry groups, 233 companies; introduced

base-weighted aggregate technique to gauge stock market

performance; 1926

- created 90 Stock Composite Price Index, comprised 50

Industrials, 20 Rails, 20 Utilities; base period of 1926=100,

calculated and published weekly; historical values available to

1918; "233", industry group indices re-based to 1926=100,

calculated and published weekly;

1928 - 90 Stock Composite Price Index

calculated, published daily; 1941

- "233" grew o 416, comprised 72 industry sub-groups; "416", 90

Stock Composite re-based to 1935-39=100;

1957 - "416" became Standard & Poor's

500 Composite Stock Price Index; introduced computers, permitted

"500" to be calculated, disseminated at one-minute intervals

throughout trading day; new "500" linked to 90 Stock Composite

Price Index; daily S&P 500 Index prices available to 1928; "500"

consisted of 425 Industrials, 60 Utilities, 15 Rails; base

period of 1941-43=10.

May 13, 1927

- "Black Friday" on Berlin Stock Exchange.

October 1, 1928

- Dow Jones Industrial Average expanded from 20 to 30 stocks.

May 21, 1929

- Sutro and Company of New York City put automatic

electric stock quotation board into operation.

August 9, 1929

- Brokers' loans set record for fourth successive week,

passed $6,000,000,000 mark for first time; directors of

Federal Reserve Bank of New York advanced rediscount

rate from 5% (level held since July 13, 1928) to 6%;

August 10 - Dow dropped

14.11 points to close at month-long low of 337.99; record-setting run

had lasted over a

year.

September 3, 1929

- Dow Jones Industrial Average closed at pre-Crash

high of 381.17.

October 29, 1929 (Black Tuesday)

- Stock prices collapsed on New York Stock Exchange

amid panic selling; most disastrous trading day in stock market's history;

billions of dollars in open

market values, thousands of investors, wiped out as

prices crumbled under pressure of liquidation of

securities which had to be sold at any price;

estimated that 880 issues on New York Stock Exchange

lost between $8,000,000,000 and $9,000,000,000 plus depreciation on

issues on Curb Market, in over the counter

market, on other exchanges; leading stocks rallied in final fifteen minutes of trading

in

measurable snapback from lows: American Can gained

10; United States Steel common, 7 1 /2, General

Electric, 12; New York Central, 14 1/2, Anaconda Copper,

9 1/2; Chrysler Motors 5 1/4; Montgomery Ward, 4 1/4 and

Johns Manville, 8; collapse started Thursday, October

24, when 12,800,000 shares traded on Exchange; storm broke again on

Monday across board in every industry, followed tremendous trading of 16,410,030 shares

on Tuesday.

February 2, 1932

- Federal Reserve announced ban on bank loans for

margin trades.

July 8, 1932 -

Stock market fell to

lowest point during Depression (41.22).

1935

- FT-30 index founded; 2007 - only three

companies from original FT-30 index still listed (GKN,

ICI, Tate & Lyle).

October 31, 1938

- New York Stock Exchange unveiled fifteen-point program

aimed to upgrade protection for investing public,

restore confidence.

April 1942

- Sidney B. Wachtel, international financial economist for U.S.

Treasury Department, published "Certain Observations on Seasonal

Movements in Stock Prices" (p. 184) in Journal of Business

(published by University of Chicago Press); coined term "January

Effect", theory that American stock prices rise more in January

than any other month; 1961

- founded Wachtel & Co., Washington-based investment. brokerage

firm.

May 16, 1949 -

Nikkei Stock Average published (price-weighted average of 225

top-rated Japanese companies listed in First Section of Tokyo

Stock Exchange); average price was ¥176.21, with divisor of 225.

March 12, 1956

- Dow Jones closed above 500 for first time (500.24).

March 1, 1957

- Standard & Poor's Corporation ( Standard

Statistics Company merged with Poor's Publishing in

1941) introduced S & P 500 Index (with daily estimates),

representative sample of 500 leading companies in

leading industries of U.S. economy (predecessor stock

market indicator - Standard Statistics Company Average

of Stock Prices developed in 1926 = 100); characterized

by: 1) approximately 75% of U.S. equities market

covered; 2) market capitalization weighted, 3) minimum o

$ 4 billion capitalization, 4) at least 50% public

float, 5) reconstituted as needed; 1957 -

a) 'materials' (steel, aluminum, chemical, paper,

mining) biggest industrial sector represented, b)

materials, energy = 50% of index value (12% in 2006); c)

AT&T largest company - $11.2

billion market capitalization;

1957-2006

- 1) average annual return of 10.83% ($1000 in S & P in

1957 = $168,000 in 2006); 2)

best performing company - Altria (old Philip Morris)

with 19.88% annual return ($1000 in 1957 = $8.4 million

in 2006); 3)

111 companies survived intact (PepsiCola, Coca-Cola,

Colgate Palmolive, Heinz, Wrigley, Procter & Gamble,

Hershey, Tootsie Roll Industries); 4) almost 1,000

companies have been added to index as others were

dropped (bankruptcies, mergers, corporate changes).

1960

- James

Lorie, Lawrence Fischer (University of Chicago Graduate School

of Business), with a grant of $ 300,000 from Merrill Lynch,

established Center for Research in Securities Prices (CRSP) at

University of Chicago (Fischer originated structure of CRSP

Master File; 1964

- completed stock market database (estimated to contain between

2-3 million pieces of information); allowed average rate of

return on common stocks to be measured for first time (9% on

NYSE-listed stocks); enabled rigorous empirical analysis of

stock prices, investment theories; allowed maintenance of

accurate securities information over time;

1984 - added data from NASDAQ markets

(from December 1972); mid 1990s

- created only complete database available containing active,

inactive mutual funds; 2005

- released CRSP/Ziman Real Estate Data Series (with Ziman

Center at the Anderson School of Business of UCLA);

2006 - released

Pre62 database (contained daily data from 1926 - 1962 vs. only

monthly data previously available).

February 12, 1970

- Joseph Louis Searles III became first black member of New York Stock Exchange.

February 8, 1971

- Gordon Macklin, president of National Association of

Securities Dealers opened NASDAQ (National Association of

Securities Dealers Automated Quotations); system went live via

cathode-ray terminals to more than 500 market-makers across the

U. S. in stocks of 2,500 companies; trading volume of 2.2

billion shares; 1973 - volume twice as big as

AMEX; 1983 - topped NYSE in single-day trading

volume seven times; 1987 - regulated activities of

almost 7,000 broker-dealer members with 400,000 employees;

listed 4.500 companies; trading volume of 30 billion shares;

2006 - Nasdaq Stock Market, Inc. (for-profit company

separate from NASD) trading volume of 482.3 billion shares (vs.

405.9 billion shares on the NYSE [608.2 billion shares in NYSE

composite volume]).

November 14, 1972

- Dow Jones Industrial Average closed above 1,000 for first time, at 1,003.16; International Business Machines, Wall

Street's best known glamour issue, moved up 11 1/4 points to

388, its best price of day; American Telephone rose 5/8 to

51 1/2, finishing at its highest price since early 1971; du

Pont, up 2 3/8 to 177 3/8, Chrysler, up 1 1/8 to 38 1/8;

Polaroid, up 6 to 115, Johnson and Johnson, 5 1/4 to 128 3/4;

Disney, 3 3/8 to 189; Motorola, 4 to 121 1/2; ARA Services, 5

3/4 to 142 3/4; Texas Instruments, 6 5/8 to 166, Xerox, 4

3/8 to 151 5/8.

1973

- Derivatives - Fisher Black, Myron Scholes

published Black-Scholes Option Pricing Formula in Journal of

Political Economy; specified first successful options pricing

formula (mathematics of

option pricing, dynamic hedging strategies using options and

other derivatives); described general framework

for pricing derivative securities, created financial

engineering; one of most important mathematical

tools in modem theory of finance (Black, F. and Scholes, M.

[1973]. "The Pricing of Options and Corporate Liabilities".

Journal of Political Economy, Vol. 86, p.637).

April 26, 1973 -

Chicago Board Options Exchange opened for trading (911 contracts

on 16 underlying stocks).

1974

- Michael Milken created market for high-yield bond trading;

based on research of W. Braddock Hickman, former

president of the Federal Reserve Bank of Cleveland (Corporate

Bond Quality and Investor Experience, Princeton, NJ: Princeton

University Press, 1958) - corporate default history 1900-1943:

diversified long-term portfolio of

non-investment-grade debt securities outperformed portfolio of

investment-grade debt, with the same level of risk.

May 1, 1975 -

New York Stock Exchange abolished fixed commissions per share on

trades in favor of negotiated commission rate structure;

wrought havoc on brokerage firm revenue-generating prospects.

1977 - LBOs -

Kohlberg Kravis Roberts & Co. (formed in May 1, 1976 by former

Bear Stearns executives Jerome Kohlberg, Henry Kravis, George

Roberts) financed $26 million leveraged buyout of A.J.

Industries, publicly-traded small manufacturer of brake drums

and other components (66% leverage financed with senior bank

debt); firms' first deal; couldn't persuade anyone to provide

subordinated debt (first LBO done in 1963 - Lewis B. Cullman

acquired Orkin Exterminating for $62.4 million with a $1,000

investment); May 14, 1979

- acquired Houdaille Industries in $355 million buyout; first

public-to-private transaction (leveraged buyout of a publicly

traded company); took almost one year to raise $355 million from

several banks, insurance companies for deal with 86% leverage

financed by multi-layered array of senior, subordinated

securities.

1977 -

Securitization - Salomon Brothers (Lewis S. Ranieri)

and Bank of America Corp. (BAC ) developed first private

(non-Government Sponsored Enterprise) mortgage-backed securities

(MBS); bonds pooled thousands of mortgages, passed homeowners'

payments through to investors (only 15 states recognized MBS as

legal investments); created "securitization," converting of home

loans into bonds that could be sold anywhere in world = capital

markets as source of funds for housing, commercial real estate;

1982 - developed

"collateralized mortgage obligation" (repackaged pools of

30-year mortgages into collections of 2-, 5-, and 10-year bonds

to sell to wide range of investors; seen as template for cutting

costs); led effort to obtain federal legislation to support,

build the market (Tax Reform Act of 1986);

1999 - size of market was $678 billion (41.6%

credit card receivables, 19.8% home equity loans, 11.8% auto

loans); 2008 -

size of market $531.2 trillion. (see graph below).

April 1977

- Junk Bonds - Drexel Burnham underwrote first junk

bond issue, Texas International;

end of 1978 - Drexel number one issuer;

used financial innovation as low-cost solution to

raising capital; created high-yield new-issue bond market;

1981 - issued

bonds for leveraged buyouts; 1983

- provided junk bond financing for hostile takeovers (leveraged

buyouts taken against incumbent directors’ will);

March 1985 -

completed first junk bond-financed hostile takeover.

August 12, 1982

- Bull Run of 1980s began, from level of 776.92 on Dow, five-year run

to 3000 point barrier; 1987 - 500-point crash.

February 24, 1983

- Dow Jones closed above 1100 mark for first time.

January 3, 1984

-

FTSE International, joint venture

of London Stock Exchange and The Financial Times (subsidiary of

Pearson),

compiled

FTSE-100,

capitalization-weighted index of 100 most highly capitalized

traded companies (base level of 1000); July

1, 2009-September 30, 2009 - best quarter in its

25-year history.

February 13, 1985

- Dow Jones closed at 1297.92 (record high) after topping 1300

earlier.

January

8, 1987 - The Dow Jones industrial average closed above

2,000 for first time, ended at 2,002.25.

April 21, 1987 - Dow Jones Industrial Average

soared 664.7; second biggest one-day gain in history.

March 12, 1987

- Dow Jones Industrial Average added Coca-Cola, Boeing Company;

dropped Inco Ltd., Owens-Illinois Glass.

July 17, 1987

- Dow Jones closed above 2,500 (2,510.04) for first time.

August 13, 1987

- Wall Street celebrated five-year anniversary of dawn

of Bull Run by shortly surging past 2,700-point mark; Dow Jones Industrial Average closed at 2,691.49;

August 17, 1987

-

closed above 2,700 for first time (2,700.57).

August 21, 1987 -

Bull run topped out at then-unprecedented 2772.4 points.

October 19, 1987

- Stock market crashed; Dow Jones Industrial

Average plunged 508 points (22.6%) -

second biggest percentage drop; 604 million share volume, nearly

doubled record; tape 2 hours late.

January 29, 1989

- Dow jumped 38.06 recouped 508-pt loss since Oct 1987; index at

2,256.43.

April 17, 1991 - Dow Jones industrial

average closed above 3,000 for first time.

October

30, 1991 - BET Holdings Inc. became first

African-American company listed on New York Stock Exchange.

February 23, 1995

- Dow Jones closed above 4,000 for first time (4,003.33).

November 21, 1995

- Dow Jones industrial average closed above 5,000 for first time.

December 15, 1995

- Big Board trading hit record: 652.8 million shares traded,

topped old mark of 608.2 million shares set on October 20, 1987.

October 14, 1996

- Dow Jones Industrial Average gained 40.62 to 6,010.00;

closed above 6,000 for first time.

November 25, 1996

- Dow charged past 6,500 for first time in history

(confidence in dollar, dwindling interest rates on U.S.

Treasury Bonds).

February 13, 1997

- Dow Jones industrial average broke 7,000

barrier for first time, closed at 7,022.44.

October 27, 1997

- By 2:00 P.M., Dow had dropped 323.42 points; Wall Street

invoked "circuit-breaker rules" (passed in wake of

1987 crash); mandated trading halts or "cooling off" periods to

be invoked when market dropped so many points that it seemed

headed for disaster; October 28,

1997 -

Dow surged to record gain of 337.1 points.

November 24, 1997

- Dow dropped 554.26 points, New York Stock Exchange officials

invoked the "circuit breaker" rule for first time;

halted trading; subsequent changes to "circuit breaker"

rules ensured that trading halts only implemented when

Dow Jones industrial average dropped by at least 10-20%.

April 3, 1998

-Dow Jones industrial average climbed above 9,000 for first time.

March 29, 1999

- Dow Jones industrial average closed above 10,000 for first time, at 10,006.78.

December 29, 1999

- Nasdaq composite index closed above 4,000 for first

time, ended at 4,041.46.

January 14, 2000

- Dow Jones Industrials closed at an all-time high,

11,722.98.

March 10, 2000

- NASDAQ Composite Index traded to intraday high of 5132.52,

closed at 5048.62, peak of Internet bubble;

October 2002 - hit low of 1108, loss of 78%.

(source:

http://bigpicture.typepad.com/comments/images/wsj_infonasbubble0503_3.gif)

(source:

http://bigpicture.typepad.com/comments/images/wsj_infonasbubble0503_3.gif)

August 28, 2000 -

New York Stock Exchange began listing prices of seven stocks in

dollars and cents; previously all stock quoted in fractions.

September 17, 2001

- Wall Street trading resumed for first time since

Sept. 11 terrorist attacks - longest shutdown

since Depression; Dow lost 684.81 points,

worst-ever one-day point drop.

September 17, 2003

- New York Stock Exchange chairman Dick Grasso resigned

amid furor over his $139.5 million pay package.

March 8, 2006

- New York Stock Exchange went public.

October 19, 2006

- Dow Jones Industrial Average closed above 12,000 for

first time in history (12011.73, up 19.05).

April 25, 2007

- Dow Jones Industrial Average closed above 13,000, at

13,089.89, for first time, up 135.95 on volume of more

than 250 million shares.

July 19, 2007

- Dow Jones Industrial Average closed above 14,000 for

first time in history, at 14,000.41.

October 9, 2007

- S&P 500 traded to record high, 1,565.15.

November 5, 2007

- PetroChina, subsidiary of China's state-owned China National

Petroleum, first half 2007 revenues less than one-third of Exxon

Mobil, debuted on Shanghai Stock Exchange (13% of available

float), tripled in price, became most valuable company in

corporate history with market capitalization in excess of $1

trillion.

20-year winners

(October

19, 1987 - October 18, 2007) -

Twenty stocks in S&P 1,500

index that delivered highest total return

over 20 years, since 1987 stock market crash.

| Company |

20-year total return*

|

Business |

| International Game

Technology |

35,080% |

Casino gaming systems |

| UnitedHealth Group |

32,984 |

Health maintenance

organization |

| Jack Henry & Assoc. |

22,811 |

Computer systems for

financial institutions |

| NBTY |

20,451 |

Nutritional supplements

(Nature's Bounty) |

| WMS Industries |

19,060 |

Gaming, lottery machines |

| Kansas City Southern |

17,201 |

Railroad |

| Fastenal |

17,199 |

Distributes industrial

supplies |

| Oracle |

13,290 |

Business software |

| Weatherford Intl. |

12,923 |

Oil field services |

| Micros Systems |

12,876 |

Computer systems for

hospitality |

| Jefferies Group |

12,846 |

Investment banking |

| Best Buy |

12,283 |

Electronics retailer |

| Eaton Vance |

12,202 |

Mutual funds |

| Harley Davidson |

12,055 |

Motorcycles |

| Sierra Health Services |

11,770 |

Managed health care |

| Expeditors International

|

11,454 |

Transportation logistics |

| Microsoft |

11,447 |

Software |

| Amgen |

11,424 |

Biotechnology |

| Clear Channel

Communications |

11,219 |

Broadcasting |

*Includes share-price appreciation

plus dividends from Oct. 19, 1987, through Wednesday.

Returns are adjusted for splits and spin offs. Source:

FactSet Research Systems, SF Chronicle research;

http://www.sfgate.com/cgi-bin/article.cgi?file=/c/a/2007/10/18/BUODSRIN6.DTL&type=printabletrillion.

STOCK MARKET RETURNS: Annual Returns on

Stock, T. Bonds and T. Bills:

1928 - Current

(raw data from St. Louis Federal Reserve data site)

|

Annual Returns on

Investments in |

Compounded Value of $ 100 |

|

Year |

Stocks |

T.Bills |

T.Bonds |

Stocks

|

T.Bills

|

T.Bonds |

|

1928 |

43.81% |

3.08% |

0.84% |

$ 143.81

|

$ 103.08

|

$ 100.84

|

|

1929 |

-8.30% |

3.16% |

4.20% |

$ 131.88

|

$ 106.34

|

$ 105.07

|

|

1930 |

-25.12% |

4.55% |

4.54% |

$ 98.75

|

$ 111.18

|

$ 109.85

|

|

1931 |

-43.84% |

2.31% |

-2.56% |

$ 55.46

|

$ 113.74

|

$ 107.03

|

|

1932 |

-8.64% |

1.07% |

8.79% |

$ 50.66

|

$ 114.96

|

$ 116.44

|

|

1933 |

49.98% |

0.96% |

1.86% |

$ 75.99

|

$ 116.06

|

$ 118.60

|

|

1934 |

-1.19% |

0.30% |

7.96% |

$ 75.09

|

$ 116.41

|

$ 128.05

|

|

1935 |

46.74% |

0.23% |

4.47% |

$ 110.18

|

$ 116.68

|

$ 133.78

|

|

1936 |

31.94% |

0.15% |

5.02% |

$ 145.38

|

$ 116.86

|

$ 140.49

|

|

1937 |

-35.34% |

0.12% |

1.38% |

$ 94.00

|

$ 117.00

|

$ 142.43

|

|

1938 |

29.28% |

0.11% |

4.21% |

$ 121.53

|

$ 117.12

|

$ 148.43

|

|

1939 |

-1.10% |

0.03% |

4.41% |

$ 120.20

|

$ 117.16

|

$ 154.98

|

|

1940 |

-10.67% |

0.04% |

5.40% |

$ 107.37

|

$ 117.21

|

$ 163.35

|

|

1941 |

-12.77% |

0.02% |

-2.02% |

$ 93.66

|

$ 117.23

|

$ 160.04

|

|

1942 |

19.17% |

0.33% |

2.29% |

$ 111.61

|

$ 117.62

|

$ 163.72

|

|

1943 |

25.06% |

0.38% |

2.49% |

$ 139.59

|

$ 118.06

|

$ 167.79

|

|

1944 |

19.03% |

0.38% |

2.58% |

$ 166.15

|

$ 118.51

|

$ 172.12

|

|

1945 |

35.82% |

0.38% |

3.80% |

$ 225.67

|

$ 118.96

|

$ 178.67

|

|

1946 |

-8.43% |

0.38% |

3.13% |

$ 206.65

|

$ 119.41

|

$ 184.26

|

|

1947 |

5.20% |

0.38% |

0.92% |

$ 217.39

|

$ 119.87

|

$ 185.95

|

|

1948 |

5.70% |

0.95% |

1.95% |

$ 229.79

|

$ 121.01

|

$ 189.58

|

|

1949 |

18.30% |

1.16% |

4.66% |

$ 271.85

|

$ 122.41

|

$ 198.42

|

|

1950 |

30.81% |

1.10% |

0.43% |

$ 355.60

|

$ 123.76

|

$ 199.27

|

|

1951 |

23.68% |

1.34% |

-0.30% |

$ 439.80

|

$ 125.42

|

$ 198.68

|

|

1952 |

18.15% |

1.73% |

2.27% |

$519.62

|

$ 127.59

|

$ 203.19

|

|

1953 |

-1.21% |

2.09% |

4.14% |

$ 513.35

|

$ 130.25

|

$ 211.61

|

|

1954 |

52.56% |

1.60% |

3.29% |

$ 783.18

|

$ 132.34

|

$ 218.57

|

|

1955 |

32.60% |

1.15% |

-1.34% |

$ 1,038.47

|

$ 133.86

|

$ 215.65

|

|

1956 |

7.44% |

2.54% |

-2.26% |

$ 1,115.73

|

$ 137.26

|

$ 210.79

|

|

1957 |

-10.46% |

3.21% |

6.80% |

$ 999.05

|

$ 141.66

|

$ 225.11

|

|

1958 |

43.72% |

3.04% |

-2.10% |

$ 1,435.84

|

$ 145.97

|

$ 220.39

|

|

1959 |

12.06% |

2.77% |

-2.65% |

$ 1,608.95

|

$ 150.01

|

$ 214.56

|

|

1960 |

0.34% |

4.49% |

11.64% |

$ 1,614.37

|

$ 156.75

|

$ 239.53

|

|

1961 |

26.64% |

2.25% |

2.06% |

$ 2,044.40

|

$ 160.28

|

$ 244.46

|

|

1962 |

-8.81% |

2.60% |

5.69% |

$ 1,864.26

|

$ 164.44

|

$ 258.38

|

|

1963 |

22.61% |

2.87% |

1.68% |

$ 2,285.80

|

$ 169.16

|

$ 262.74

|

|

1964 |

16.42% |

3.52% |

3.73% |

$ 2,661.02

|

$ 175.12

|

$ 272.53

|

|

1965 |

12.40% |

3.84% |

0.72% |

$ 2,990.97

|

$ 181.84

|

$ 274.49

|

|

1966 |

-9.97% |

4.38% |

2.91% |

$ 2,692.74

|

$ 189.81

|

$ 282.47

|

|

1967 |

23.80% |

4.96% |

-1.58% |

$ 3,333.69

|

$ 199.22

|

$ 278.01

|

|

1968 |

10.81% |

4.97% |

3.27% |

$ 3,694.23

|

$ 209.12

|

$ 287.11

|

|

1969 |

-8.24% |

5.96% |

-5.01% |

$ 3,389.77

|

$ 221.59

|

$ 272.71

|

|

1970 |

3.56% |

7.82% |

16.75% |

$ 3,510.49

|

$ 238.91

|

$ 318.41

|

|

1971 |

14.22% |

4.87% |

9.79% |

$ 4,009.72

|

$ 250.55

|

$ 349.57

|

|

1972 |

18.76% |

4.01% |

2.82% |

$ 4,761.76

|

$ 260.60

|

$ 359.42

|

|

1973 |

-14.31% |

5.07% |

3.66% |

$ 4,080.44

|

$ 273.81

|

$ 372.57

|

|

1974 |

-25.90% |

7.45% |

1.99% |

$ 3,023.54

|

$ 294.21

|

$ 379.98

|

|

1975 |

37.00% |

7.15% |

3.61% |

$ 4,142.10

|

$ 315.24

|

$ 393.68

|

|

1976 |

23.83% |

5.44% |

15.98% |

$ 5,129.20

|

$ 332.39

|

$ 456.61

|

|

1977 |

-6.98% |

4.35% |

1.29% |

$ 4,771.20

|

$ 346.85

|

$ 462.50

|

|

1978 |

6.51% |

6.07% |

-0.78% |

$ 5,081.77

|

$ 367.91

|

$ 458.90

|

|

1979 |

18.52% |

9.08% |

0.67% |

$ 6,022.89

|

$ 401.31

|

$ 461.98

|

|

1980 |

31.74% |

12.04% |

-2.99% |

$ 7,934.26

|

$ 449.63

|

$ 448.17

|

|

1981 |

-4.70% |

15.49% |

8.20% |

$ 7,561.16

|

$ 519.28

|

$ 484.91

|

|

1982 |

20.42% |

10.85% |

32.81% |

$ 9,105.08

|

$ 575.62

|

$ 644.04

|

|

1983 |

22.34% |

7.94% |

3.20% |

11,138.90

|

$ 621.32

|

$ 664.65

|

|

1984 |

6.15% |

9.00% |

13.73% |

11,823.51

|

$ 677.24

|

$ 755.92

|

|

1985 |

31.24% |

8.06% |

25.71% |

15,516.60

|

$ 731.83

|

$ 950.29

|

|

1986 |

18.49% |

7.10% |

24.28% |

18,386.33

|

$ 783.79

|

$ 1,181.06

|

|

1987 |

5.81% |

5.53% |

-4.96% |

19,455.08

|

$ 827.13

|

$ 1,122.47

|

|

1988 |

16.54% |

5.77% |

8.22% |

22,672.40

|

$ 874.86

|

$ 1,214.78

|

|

1989 |

31.48% |

8.07% |

17.69% |

29,808.58

|

$ 945.46

|

$ 1,429.72

|

|

1990 |

-3.06% |

7.63% |

6.24% |

28,895.11

|

$ 1,017.59

|

$ 1,518.87

|

|

1991 |

30.23% |

6.74% |

15.00% |

37,631.51

|

$ 1,086.18

|

$ 1,746.77

|

|

1992 |

7.49% |

4.07% |

9.36% |

40,451.51

|

$ 1,130.39

|

$ 1,910.30

|

|

1993 |

9.97% |

3.22% |

14.21% |

44,483.33

|

$ 1,166.79

|

$ 2,181.77

|

|

1994 |

1.33% |

3.06% |

-8.04% |

45,073.14

|

$ 1,202.49

|

$ 2,006.43

|

|

1995 |

37.20% |

5.60% |

23.48% |

61,838.19

|

$ 1,269.83

|

$ 2,477.55

|

|

1996 |

23.82% |

5.14% |

1.43% |

76,566.48

|

$ 1,335.10

|

$ 2,512.94

|

|

1997 |

31.86% |

4.91% |

9.94% |

100,958.71

|

$ 1,400.65

|

$ 2,762.71

|

|

1998 |

28.34% |

5.16% |

14.92% |

129,568.35

|

$ 1,472.93

|

$ 3,174.95

|

|

1999 |

20.89% |

4.39% |

-8.25% |

156,629.15

|

$ 1,537.59

|

$ 2,912.88

|

|

2000 |

-9.03% |

5.37% |

16.66% |

142,482.69

|

$ 1,620.16

|

$ 3,398.03

|

|

2001 |

-11.85 |

5.73% |

5.57% |

125,598.83

|

$ 1,712.99

|

$ 3,587.37

|

|

2002 |

-21.98 |

1.80% |

15.12% |

97,996.61

|

$ 1,743.82

|

$ 4,129.65

|

|

2003 |

28.41% |

1.80% |

0.38% |

125,838.91

|

$ 1,775.21

|

$ 4,145.15

|

|

|

|

|

|

Risk Premium

|

|

|

Arithmetic Average |

|

|

|

|

Stocks - T.Bills

|

Stocks -

T.Bonds |

|

1928-2003 |

11.82% |

3.90% |

5.28% |

|

7.92%

|

6.54% |

|

1963-2003 |

12.10% |

6.01% |

7.40% |

|

6.09%

|

4.70% |

|

1993-2003 |

12.63% |

4.20% |

7.76% |

|

8.43%

|

4.87% |

|

|

|

|

|

Risk Premium

|

|

|

Geometric Average |

|

|

|

|

Stocks - T.Bills

|

Stocks -

T.Bonds |

|

1928-2003 |

9.85% |

3.86% |

5.02% |

|

5.99%

|

4.82% |

|

1963-2003 |

10.82% |

5.97% |

7.00% |

|

4.85%

|

3.82% |

|

1993-2003 |

10.87% |

4.19% |

7.30% |

|

6.68%

|

3.57% |

(http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html)

October 9, 2007 - Stock market's

all-time high; total value of all stocks covered by Dow

Jones Wilshire 5000 = just over $19.1 trillion; October

8, 2008 - total value = about $11.7 trillion, down $7.4

trillion (about 40).

December 31,

2007 - Dow Jones Industrial Average closed at

13,264.82, an annual increase of 6.43% (vs. 16.29% jump in 2006;

6.3% down from all-time high October 2007); S&P 500 index

(companies with median market value of $12.8 billion) closed at

1468.36, an annual gain of 3.53%, up 10% excluding financial

stocks (6.2% below record close on October 9, 2007; down 3.8% in

fourth quarter, first for any fourth quarter in seven years; up

67% since 2002; first November/December decline since 1974);

Russell 2000 closed at 766.03, down 2.8% in 2007 (first loss in

five years, underperformed S&P 500 for first time since 1998);

Nasdaq closed at 2652.28, up 9.81% for the year (down 7.2% from

record high in October 2007); Dow Jones Wilshire 5000 Index

(companies with median market value of $589.6 million), broadest

measure of U.S. shares, closed at 14,819.58 ($115 billion

decrease in value of stocks); Chicago Board Options Exchange

Volatility Index (VIX), market's "fear gauge'' (rises as stocks

fall), closed at 22.50 (up 95% percent in 2007, biggest annual

rise in its 18-year history).

Market Performance after Fed Rate Increases

(median performance of the S&P 500 for a given number of

trading days after successive Fed rate increases since

1946).

Rate

increase 7 days

22 days 126 days

252 days

First

-0.57% 0.76%

3.91% 9.87%

Second 0.05

0.96 3.93

6.45

Third

0.23 -0.36

3.46 -2.72

Fourth

0.33 1.95

-1.37 -2.79

Fifth

-1.44

-1.12 -5.38

-2.86

Sixth

0.13 -1.92

-5.20 -6.98

Source: Leuthold Group

(http://www.cboe.com/micro/vix/images/VIX_since_1990.gif)

(http://www.cboe.com/micro/vix/images/VIX_since_1990.gif)

January

2008 - Peak to Trough Comparisons of Market Declines

(http://graphics8.nytimes.com/images/2008/01/18/business/0118-biz-STOX-full.jpg)

(http://graphics8.nytimes.com/images/2008/01/18/business/0118-biz-STOX-full.jpg)

L-R:

1/1/73-12/6/74 (-45.1%); 11/29/83-7/24/84 (-15.6%);

8/25/87-10/19/87 (-36.1%); 7/16/90-10/11/90 (-21.2%);

7/17/98-8/31/98 (-19.3%); 1/14/00-10/9/02 (-37.8%);

10/9/07-1/17/08 (-14.2%).

January 17, 2008

- NYSE Euronext agreed to acquire American Stock Exchange for

$260 millionto increase its business in options, exchange-traded

funds, cash products.

January 25, 2008

- Biggest Trading Losses by 'Rogue Traders'

(http://graphics8.nytimes.com/images/2008/01/25/business/20080125_BANK.jpg)

(http://graphics8.nytimes.com/images/2008/01/25/business/20080125_BANK.jpg)

(source: Bloomberg;

http://graphics8.nytimes.com/images/2008/03/29/business/29-biz-CHARTS-full.jpg)

(source: Bloomberg;

http://graphics8.nytimes.com/images/2008/03/29/business/29-biz-CHARTS-full.jpg)

March 31, 2008 - London’s

FTSE

100 index closed at 5702.1, off 11.9 per cent for the first

three months of the year = the index’s worst opening quarter

since it was launched 24 years ago on January 3, 1984 (3Q 2000

-fell 20%); reasons -

subprime

crisis, slowing housing market (Building Society reported 5th

consecutive drop in housing prices), consumer confidence in the

UK is at its lowest for 15 years (data from pollsters

GfK/NOP

showed the confidence worsened for a seventh month in a row,

lowest level since 1993).

June 30, 2008

- End of 2nd

Q 2008:

Standard & Poor’s 500-stock index down 8.6% in June 2008, down

12.8% for the first half of 2008 = worst performance in June

since 1930 (down 16.5%).

Index introduced March 1, 1957 (with daily) estimates

(predecessor stock market indicator - Standard Statistics

Company Average of Stock Prices developed in 1926 = 100); Dow

Jones industrial average off 14.4% for the first half of 2008.

August 2, 2008 -

Half of consumers polled by Conference Board expect stock prices

to decline over next 12 months (first time); 6 previous cycles

when at least 36% of those responding were bearish.

October 2008 -

Worst September for dividends since 1956; 138 of approximately

7,000 publicly owned companies that report dividend information

to Standard & Poor's Dividend Record decreased their dividend

during third quarter of 2008 (vs. 21 in 2007); reported dividend

increases fell 21.2% to 346 from 439 reported in third quarter

of 2007.

(http://graphics8.nytimes.com/images/2008/08/02/business/0802-biz-CHARTSweb.gif)

October 2008 -

Worst September for dividends since 1956; 138 of approximately

7,000 publicly owned companies that report dividend information

to Standard & Poor's Dividend Record decreased their dividend

during third quarter of 2008 (vs. 21 in 2007); reported dividend

increases fell 21.2% to 346 from 439 reported in third quarter

of 2007.

October

2008 - Size of Market for Derivative Products.

(http://graphics8.nytimes.com/images/2008/10/09/business/1009-web-GREENSPAN.gif)

(http://graphics8.nytimes.com/images/2008/10/09/business/1009-web-GREENSPAN.gif)

October 8,

2008 - Total value of Dow

Jones Wilshire 5000 = about $11.7 trillion, down $7.4 trillion

(about 40%) from October 9, 2007

- stock market's all-time high; total value of all stocks = just

over $19.1 trillion.

(http://bigcharts.marketwatch.com/kaavio.Webhost/charts/big.chart?nosettings=1&symb=.dji&uf=128&type=2&size=4&sid=1643&style=320&freq=1&entitlementtoken=

0c33378313484ba9b46b8e24ded87dd6&time=13&rand=1754972358&compidx=aaaaa%3a0&ma=0&maval=9&lf=2&lf2=4&lf3=16&height=981&width=1045&mocktick=1)

October 8,

2008 - Margin debt

increased from 2002-2007 (NYSE);

July 2007 - peak of $381 billion (market peaked

in October 2007):

(http://graphics8.nytimes.com/images/2008/10/13/business/1013-biz-MARGIN-web.gif)

(http://graphics8.nytimes.com/images/2008/10/13/business/1013-biz-MARGIN-web.gif)

October 13,

2008 - Biggest single

1-day point gain in trading history: up 936.42 points to close

at 9387.61 (11.08%); March 15,

1933 - biggest single 1-day percentage gain : up

8.26 points to close at 62.10 (15.34%).

(http://markets.on.nytimes.com/research/tools/builder/api.asp?sym=$DJI&duration=1&chartstyle=Home&w=337&h=255&display=lineclip&topLabel=Dow%20Industrials)

(http://markets.on.nytimes.com/research/tools/builder/api.asp?sym=$DJI&duration=1&chartstyle=Home&w=337&h=255&display=lineclip&topLabel=Dow%20Industrials)

November 20,

2008 - S&P 500 traded to 11-year low, down 49%

for year, down 52% from October 9, 2007 record (1,565.15);

first loss greater than 30% since 39% decline in

1937 (lost 23% in 2002, lost 29.7% in 1974, followed by annual

gains of 26%, 32%, respectively); financial companies

suffered most severe decline among 10 main industries in S&P

500, down 58% collectively (worst drop in 19-year history of

index tracking group).

December 31,

2008 - Dow Jones industrial average ended year

down more than 34%, worst year for index since 1931; broader

Standard & Poor’s 500-stock index lost more than 38%; all but 2

of the 30 Dow industrials (Wal-Mart, McDonalds) fell by more

than 11% (General Motors, Citigroup, Alcoa lost more than 70% of

their value); about $7 trillion of shareholders’ wealth (gains

of last six years) wiped out; stocks have fallen 55%-72% percent

in Brazil, Russia, India, China (so-called BRIC economies);

since September 2008

- 18 days when S.& P. moved more than 5% in either direction

(only 17 such days in previous 53 years;

source: calculations by Howard Silverblatt,

S&P an index analyst).

1999-2009

- Worst decade in 82 years of S & P 500 history (assumes CPI

unchanged January from December):

through January 2009: investor holding stocks

of S.& P.’s 500-stock index, reinvesting dividends, would have

lost about 5.1%/year, after adjusting for inflation (-2.6%/year,

before factoring in inflation); 23.5% total losses in nominal

dollars from S.& P. 500, with dividends reinvested (compounding

interest; -40.4% with inflation added);

September 30, 1929-September 30, 1939: -5%/year compound annual decline, with dividends reinvested,

before considering inflation (-2.8%/year , after factoring in

deflation); September 1964

-September 1974: compound annual decline of

4.3%/year (0.5%/year, before factoring in inflation); bad

decades often followed by 10-year periods that are better than

long-term average (gain of 6.2%/year).

(http://graphics8.nytimes.com/images/2009/02/06/business/0207-biz-CHARTSweb.gif)

(http://graphics8.nytimes.com/images/2009/02/06/business/0207-biz-CHARTSweb.gif)

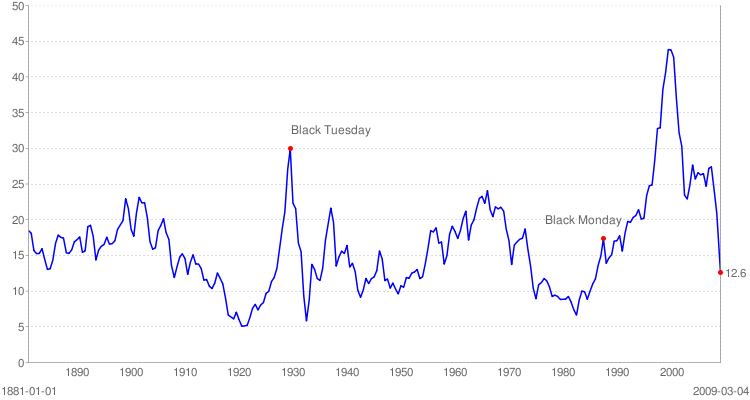

S&P 500 P/E Ratio - Monthly chart 1900-2009

(smoothed over 10 years to remove short-term volatility); July

1921 - P/E Ratio below 6; July 1932 - P/E ratio = below 6;

August 1982 - P/E of 7; 1929 - P/E Ratio = 33; 2000 - P/E Ratio

= 44

(http://www.ritholtz.com/blog/wp-content/uploads/2009/03/historic-pe-ratio-for-the-sp-500.png)

March 2009 -

82% of announced dividend changes negative

(eliminations or reductions of payouts) = highest recorded by

S.& P. since it began tallying figures in 1955.

August

3, 2009 - Best Five-Month Run Since 1938; best

July in 12 years (S&P 500 up 7.4%, 8.6% for Dow, 7.8% for Nasdaq,

9.5% for Russell); 80% of stocks above their 200-day averages

(just 1% in early March 2009); market breadth strongest in more

than year; many credit, economic indicators have recovered to

levels before Lehman Brothers's collapse in September 2008;

April-June 2009 - companies raised $92 billion in public

offerings, highest three-month issuance in two decades

(http://s.wsj.net/public/resources/images/ON-AM325_bTrade_NS_20090731213054.gif)

(http://s.wsj.net/public/resources/images/ON-AM325_bTrade_NS_20090731213054.gif)

October 15, 2009 -

Big Board getting smaller; closed

one of five trading halls; 2006-2009

- 36% of daily trades in stocks listed on New York

Stock Exchange executed on exchange, down about 75%

(rest conducted elsewhere, on new electronic exchanges

or through dark pools);

January 2007-October 2009 -

share price of NYSE Euronext has lost nearly

three-quarters of its value, while stock trading has

soared.

(http://graphics8.nytimes.com/images/2009/10/15/business/1015-biz-EXCHANGE-JMP.jpg)

(http://graphics8.nytimes.com/images/2009/10/15/business/1015-biz-EXCHANGE-JMP.jpg)

November

21, 2009 -

S&P 500 up 64% since it hit bottom in March 2009, to

1,100; S.& P. Europe 350 and the S.& P./Topix

150 (covering Japan) - 1) local currencies

- prices are lower than in 1998; 2) American dollars - markets

gained 20% and 7%, respectively, because of currency movements (March 24, 1998 -

S&P 500 index first reached 1,100;

1998-2009 -

U.S. = worst regional index in which to have invested;

higher returns in emerging markets [Latin America, Australia,

emerging Asian countries, Canadian index due to natural

resources stocks] than in the developed world; energy stocks -

best performing sector [oil prices fell to about $10 a

barrel in late 1998, rose above $140/barrel as company profits

set records, price is more than $70/barrel after economic

downturn]; late 1990s -

United States stock market was world leader in great bull

market; laggard more recently [weakness of the dollar];

2003-2008 -

International 700 [non-American stocks in the S.& P. Global

1,200] rose much faster in the middle of the decade, fell faster

in the global recession, up more than 80% since March 2009.

(http://graphics8.nytimes.com/images/2009/11/20/business/1121-biz-webCHARTS.gif)

(http://graphics8.nytimes.com/images/2009/11/20/business/1121-biz-webCHARTS.gif)

(Deutsche Borse AG), Werner G.

Seifert, Hans Hans-Joachim Voth (2006).

Invasion of the Grasshoppers. Plots - Struggles for Power -

Market Manipulation. (Berlin, Germany:

Ullsteinbuchverlage/Econ, 272 p.). Former CEO Deutsche Borse;

ICREA Research Professor at the Economics Department (Universitat

Pompeu Fabra, Barcelona), Associate Director at the Centre for

History and Economics (King's College, Cambridge). Siefert,

Werner G.; Deutsche Borse AG--Management; Executives--Germany

--Biography; Stock Exchanges--Germany--Management--Case studies.

Memoir of ouster after 12-years as CEO of

Deutsche Borse AG.

(Paris Bourse), Pedro Arbulu (2007).

La Bourse de Paris au XIXe Siècle: Efficience et Performance

d'un Marché Financier Emergent. (Paris, FR:

Connaissances et Savoirs, 252 p.). Bourse de Paris -- History --

19th century; Stock exchanges -- France -- Paris -- History --

19th century.

(Philadelphia Stock Exchange), Domenic

Vitiello, with George E. Thomas (2010).

The Philadelphia Stock Exchange and the City It Made.

(Philadelphia, PA: University of Pennsylvania Press, 253 p.).

Teaches City and Regional Planning (University of Pennsylvania);

Teaches Urban Studies (University of Pennsylvania). Philadelphia

Stock Exchange --History; Stock exchanges --Pennsylvania

--Philadelphia --History; Finance --Pennsylvania --Philadelphia

--History; Philadelphia (Pa.) --History. Metropolitan economic

development; America's first stock exchange (1790), ways it

shaped growth, decline of city around it; exchange, its

members helped spur development of early United States, its

financial sector, its westward expansion; made Philadelphia

center of industrial America: raised capital for railroads and

coal mines that connected cities to one another , built fossil

fuel-based economy; after financing Civil War, underwrote growth

of modern metropolis, its transportation infrastructure, utility

systems, real estate development; exchange's fortunes diverged

from those of city around it; became part of larger, global

institution (merged with NASDAQ in 2008).

Patricia A. Adler and Peter

Adler (1984).

The Social Dynamics of Financial Markets (Greenwich, CT:

JAI Press, 212 p.). Stock exchanges--Sociological aspects.

Christopher Armstrong (2001).

Moose Pastures and Mergers: The Ontario Securities Commission

and the Regulation of Share Markets in Canada, 1940-1980.

(Toronto, ON: University of Toronto Press, 424 p.). Ontario

Securities Commission -- History; Securities -- Ontario --

History.

Hurd Baruch (1971).

Wall Street: Security Risk (Washington, DC: Acropolis

Books, 356 p.). New York Stock Exchange

Alec Benn (2000).

The Unseen Wall Street of 1969-1975: And Its Significance for

Today (Westport, CT: Quorum Books, 216 p.). New York

Stock Exchange--History--20th century; Wall

Street--History--20th century; Stock exchanges--United

States--History--20th century.

Murray T. Bloom (1971).

Rogues to Riches; The Trouble with Wall Street. (New

York, NY: Putnam, 332 p.). Wall Street.

Marshall E. Blume, Jeremy J. Siegel and Dan

Rottenberg (1993).

Revolution on Wall Street: The Rise and Decline of the New York

Stock Exchange. (New York, NY: Norton, 320 p.). New York

Stock Exchange; Stock exchanges; International finance.

Steven R. Champion (1998).

The Great Taiwan Bubble: The Rise and Fall of Asia's Most

Volatile Emerging Market. (Berkeley, CA: Pacific View

Press). Stocks--Taiwan; Securities industry--Taiwan;

Investments--Taiwan.

Henry Clews (1887).

Twenty-Eight Years in Wall Street. (New York, NY: Irving

Publishing Co., 684 p.). Wall Street; Speculation; Capitalists

and financiers--United States; Business.

--- (1908).

Fifty Years in Wall Street. "Twenty-eight years in Wall street,"

Revised and Enlarged by a Résumé of the Past Twenty-Two Years,

Making a Record of Fifty Years in Wall Street. (New

York, NY: Irving Publishing Company, 1062 p.). Wall Street;

Speculation; Capitalists and financiers--United States;

Business.

Cedric B. Cowing (1965).

Populists, Plungers, and Progressives; A Social History of Stock

and Commodity Speculation, 1890-1936 (Princeton, NJ:

Princeton University Press, 299 p.). Stock exchanges--United

States; Investments--United States. Speculation.

David Cruise & Alison Griffiths (1987).

Fleecing the Lamb: The Inside Story of the Vancouver Stock

Exchange. (Toronto, ON: Douglas & McIntyre, 277 p.).

Vancouver Stock Exchange.

Nicolas Darvas (1964).

Wall Street: The Other Las Vegas (New York, NY: Lyle

Stuart, 192 p.). New York Stock Exchange; Stocks--United States;

Speculation.

Hillary Davis (1998). A Million a Minute:

Inside the World of Securities Trading: The Men, the Women, the

Money that Make the Markets Work. (New York, NY:

HarperBusiness, 292 p.). Ex of Baring Brothers. Stockbrokers;

Floor traders (Finance).

Pauline et Dominique Destrem (2005). La

Bourse Sous l’Occupation. (Paris, FR: Mare & Martin, 327

p.). Stock exchanges--France--History--20th century;

Securities--France--History--20th century;

France--History--German occupation, 1940-1945.

Ed. Elroy Dimson (1988).

Stock Market Anomalies. (New York, NY: Cambridge

University Press, 295 p.). Stock exchanges -- Congresses;

Capital market -- Congresses.

Helga Drummond (1996). Escalation in Decision-Making: The

Tragedy of Taurus. (New York, NY: Oxford University Press,

237 p.). Professor, Organisational Learning, Behaviour and

Change, University of Liverpool Management School. Taurus

(Project); International Stock Exchange --Data processing; Stock

exchanges --Data processing --Case studies; Decision making

--Case studies. 1986-1993 - Taurus

project, 500,000 pound project to automate settlement systems on

London Stock Exchange; how could major project promoted by Stock

Exchange, supervised by committees, advised upon by two major

consultancies, staffed by experienced technical team go wrong?

why was decision to abandon project not made earlier?

Franics L. Eames (1968). The New York Stock

Exchange (New York, NY: Greenwood Press, 139 p. [Reprint

1894 ed.]). New York Stock Exchange.

Alexander Elder (2006).

Entries & Exits: Visits to 16 Trading Rooms. (Hoboken,

NJ: Wiley, 341 p.). Investment analysis; Stocks; Futures.

Psychology, tactics, risk

control, record keeping, decision-making process of traders in

16 trading rooms.

Christopher Elias (1971).

Fleecing the Lambs (Chicago, IL: Regnery, 246 p.). New

York Stock Exchange.

Ernest Feydeau (1873). Mémoires d'un

Coulissier. (Paris, FR: Librairie Nouvelle, 317 p. [2nd

ed.]). Stock jobber at Paris Borse. Paris Bourse.

Justin Fox (2009).

The Myth of the Rational Market: A History of Risk, Reward and

Delusion on Wall Street. (New York, NY: Collins, 400

p.). Business and Economics Columnist (Time magazine). Rational

expectations (Economic theory); Economics --Psychological

aspects; Economics --History; Wall Street (New York, N.Y.).

Rise

and fall of efficient market theory, century-long making of

modern financial industry; people, ideas that forged modern

finance and investing, from formative days of Wall Street

through Great Depression, into financial calamity of today;

efficient market hypothesis (EMH) evolved into powerful myth; new wave of economists, scholars who

no longer teach that investors are rational, that markets are

always right; EMH given way to counterintuitive hypotheses about

human behavior, psychological models of decision making,

irrationality of markets (investors overreact, underreact, make

irrational decisions based on imperfect data); economic

behaviors, markets shaped by gradually refined theory that stock

market prices are random, perfectly rational.

John Francis (1851). Chronicles and

Characters of the Stock Exchange ... (London, UK: Longman,

Brown, Green, & Longmans, 361 p. [2nd ed.]). Stock Exchange

(London, England); Speculation.

Martin S. Fridson (1993).

Investment Illusions: A Savvy Wall Street Pro Explodes Popular

Misconceptions About the Markets. (New York, NY: Wiley,

230 p.). Investment analysis; Stocks; Bonds; Securities.

--- (1998).

It Was a Very Good Year: Extraordinary Moments in Stock Market

History. (New York, NY: Wiley, 244 p.). Managing

Director (Merrill Lynch). Investments -- United States --

History; Stocks -- United States -- History.

John G. Fuller (1962).

The Money Changers

(New York, NY: Dial Press, 247 p.). New York Stock Exchange;

Stocks -- United States.

Charles Gasparino (2007).

King of the Club: Richard Grasso and the Survival of the New

York Stock Exchange. (New York, NY: Collins, 400 p.).

Correspondent for CNBC, Former Writer (Wall Street Journal and

Newsweek). Grasso, Richard; New York Stock Exchange--Officials

and employees--Biography; Corporations--Corrupt

practices--United States--Case studies. Most influential CEO in New York

Stock Exchange's history, mastered subtle deal-making, politics;

brought heart of global finance back from near-death after

September 11; NYSE Board rewarded him with a pay package (more

than $140 million in deferred compensation) - generated

hailstorm of protest; bitter divisions, investigation from

Attorney General, eventual downfall.

Paul Gibson (1993).

Bear Trap: Why Wall Street Doesn't Work (New York, NY:

Atlantic Monthly Press, 246 p.). New York Stock Exchange --

History; Securities industry -- United States -- History;

Stockbrokers -- United States.

Susan Goldenberg (1986).

Trading: Inside the World's Leading Stock Exchanges.

(San Diego, CA: Harcourt Brace Jovanovich, 263 p.). Stock

exchanges.

John Steele Gordon (1988).

The Scarlet Woman of Wall Street: Jay Gould, Jim Fisk, Cornelius

Vanderbilt, the Erie Railroad Wars and the Birth of Wall Street

(New York, NY: Weidenfeld & Nicolson, 421 p.). Erie Railroad,

Panic of 1873, New York Stock Exchange.

Leo Gough (1998).

25 Investment Classics: Insights from the Greatest Investment

Books of All Time (London, UK: Financial Times: Pitman

Pub., 238 p.). Investment; Speculation.

Stephen Green (2004).

The Development of China's Stock Market, 1984-2002: Equity

Politics and Market Institutions. (New York, NY:

Routledge, 287 p.). Stock exchanges China; China Economic policy

1976-2000; China Economic policy 2000-.

Lucy Heckman (1992).

The New York Stock Exchange: A Guide to Information Sources.

(New York, NY: Garland, 353 p.). Librarian (St. John's

University). New York Stock Exchange--Bibliography.

--- (2001).

NASDAQ: A Guide to Information Sources. (New York, NY:

Garland, 250 p.). Librarian (St. John's University). Nasdaq

Stock Market; Nasdaq Stock Market--Bibliography; National

Association of Securities Dealers.

Mark Ingebretsen (2002).

Nasdaq: A History of the Market That Changed the World.

(Roseville, CA: Prima, 334 p.). Nasdaq Stock Market--History.

Alan Jenkins (1973).

The Stock Exchange Story. (London, UK: Heinemann, 212

p.). Stock Exchange (London, England)--History.

Frank Keane (1981).

The Vancouver Stock Exchange: From Bucketshop to World Venture

Money Capital. (Vancouver, BC: Chinook Communications,

127 p.). Vancouver Stock Exchange.

Alan Lechner (1980).

Street Games: Inside Stories of the Wall Street Hustle

(New York, NY: Harper & Row, 176 p.). Wall Street

Louis Lowenstein (1988).

What's Wrong with Wall Street: Short-Term Gain and the Absentee

Shareholder. (Reading, MA: Addison-Wesley, 268 p.).

Stocks; Institutional investments; Stockholders; Tender offers

(Securities).

Maggie Mahar (2003).

Bull!: A History of the Boom, 1982-1999: What Drove the

Breakneck Market-- and What Every Investor Needs To Know about

Financial Cycles.

(New York, NY: HarperBusiness, 486 p.). Wall

Street--History--20th century; Stock exchanges--United

States--History--20th century; Business cycles; Stock Market

Bubble, 1995-2000.

Joseph Gregory Martin (1969). A Century of

Finance; Martin's History of the Boston Stock and Money Markets,

One Hundred Years, from January, 1798, to January, 1898,

Comprising the Annual Fluctuations of All Public Stocks and

Investment Securities ... also a review of the Boston Money

Market, 1831 to 1898 ... With Full Descriptive Notes Relating to

the Different Securities, the Whole Covering a Complete Century

of Varied Monetary Experiences. Uniform Title: [Twenty-one years

in the Boston stock market]. (New York, NY: Greenwood Press,

262 p. [reprint of 1898]). Boston; Stock Exchange; Banks and

banking--Massachusetts--Boston; Boston (Mass.)--Commerce.

Martin Mayer (1955).

Wall Street: Men and Money. (New York, NY: Harper, 274

p.). New York Stock Exchange.

--- (1988).

Markets: Who Plays, Who Risks, Who Gains, Who Loses.

(New York, NY: Norton, 303 p.). Stock exchanges; Securities.

--- (2001).

The Fed: The inside Story of How the World's Most Powerful

Financial Institution Drives the Markets. (New York, NY:

Free Press, 350 p.). Board of Governors of the Federal Reserve

System (U.S.); Monetary policy--United States; Stock

exchanges--United States.

David McClain (1988).

Apocalypse on Wall Street (Homewood, IL: Dow

Jones-Irwin, 187 p.). New York Stock Exchange; Stock exchanges;

Wall Street; Program trading (Securities).

J. Edward Meeker (1975).

The Work of the Stock Exchange (New York, NY: Ayer Pub.

Co., 720 p. [rev. ed.]). New York Stock Exchange

Ranald C. Michie (1987).

The London and New York Stock Exchanges, 1850-1914.

(London, UK: Allen & Unwin, 312 p.). Department of History

(University of Durham). Stock Exchange (London,

England)--History; New York Stock Exchange--History.

--- (1999).

The London Stock Exchange: A History. (New York, NY:

Oxford University Press, 672 p.). Department of History

(University of Durham). Stock Exchange (London,

England)--History.

--- (2007).

The Global Securities Market: A History. (Oxford, UK:

Oxford University Press, 399 p.). Department of History

(University of Durham). Securities industry -- History;

Securities -- History. Securities markets from its beginnings in Medieval Venice

through Amsterdam, London to its operations in Tokyo, New York

today.

Merton H. Miller (1991).

Financial Innovations and Market Volatility. (Cambridge,

MA: Blackwell, 288 p.). Capital market -- United States; Finance

-- United States; Stocks -- Prices -- United States; Stock

Market Crash, 1987 -- History.

Gregory J. Millman (1999).

The Day Traders: The Untold Story of the Extreme Investors and

How They Changed Wall Street (New York, NY: Times

Business, 253 p.). Electronic trading of securities;

Stocks--Data processing.

Anne L. Murphy (2009).

The Origins of English Financial Markets: Investment and

Speculation Before the South Sea Bubble. (New York,

NY: Cambridge University Press, 283 p.). Lecturer in the

Department of History (University of Exeter). Financial

institutions --England --History --17th century; Speculation

--England --History --17th century; Investments --England

--History --17th century; Financial institutions --England

--History --18th century; Speculation --England --History --18th

century; Investments --England --History --18th century.

English

Financial Revolution; English investors in 1690s – England

emerging market economy; choices, actions of investors who

enthusiastically embraced London's new financial market: host of

joint-stock companies emerged, offered opportunity for

investment in projects; state employed innovative tactics to attract

money (demands of Nine Years' War): Bank of

England incorporated; interactions between public, private

finance; how information circulated around market, used by speculators

and investors; establishment of institutions - Bank of England,

national debt, active secondary market in that debt - on which

England's financial system was built.

Russell Napier (2009).

Anatomy of the Bear: Lessons from Wall Street's Four Great

Bottoms. (Hampshire, UK: Harriman House, 320 p. [2nd

ed.]). Consultant with CLSA (Credit Lyonnais SA). Financial

crises -- United States; Stock exchanges -- New York -- New

York; Securities industry -- United States. Four occasions when

US equities were particularly cheap - 1921, 1932, 1949, 1982 -

how spot the bottom?; how markets really did work in these

bear-market bottoms.

Richard Ney (1970).

The Wall Street Jungle (New York, NY: Grove Press, 348

p.). Stock exchanges--United States; Stocks--United States.

John Lloyd Parker (1932).

Unmasking Wall Street. (Boston, MA: The Stratford

Company, 223 p.). New York Stock Exchange; Wall Street;

Capitalists and financiers -- United States.

Ferdinand Pecora (1939).

Wall Street Under Oath; The Story of Our Modern Money Changers

(New York, NY: Simon & Schuster, 311 p.). New York Stock

Exchange.

Elliott Posner (2009).

The Origins of Europe’s New Stock Markets.

(Cambridge, MA: Harvard University Press, 242 p.). Associate

Professor of Political Science (Case Western Reserve

University). Stock exchanges --Europe; Capital market --Europe;

Finance --Europe. Causes of Europe's emergence as global

financial power; origins of markets, their relationship to

politics and bureaucracy.

W.J. Reader (1979).

A House in the City: A Study of the City and of the Stock

Exchange Based on the Records of Foster & Braithwaite, 1825-1975

(London, UK: Batsford, 198 p.). Stock Exchange (London,

England)--History; Foster & Braithwaite (Firm)--History.

Eric Rosenthal (1968). On 'Change Through

the Years; A History of Share Dealing in South Africa. (Cape

Town, S. Africa: Flesch Financial Publications, 271 p.).

Johannesburg Stock Exchange; Stock exchanges--South Africa.

John Rothchild (1998).

The Bear Book: Survive and Profit in Ferocious Markets.

(New York, NY: Wiley, 284 p.). Stock exchanges; Bear market.

Anthony Rowley (1987).

Asian Stockmarkets : The Inside Story (Homewood, IL: Dow

Jones-Irwin, 290 p.). Securities--Asia; Stock exchanges--Asia.

Stephen Salsbury and Kay Sweeney (1992).

Sydney Stockbrokers: Biographies of Members of the Sydney Stock