|

1913

- Ivar Kreuger formed Svenska Tändsticks Aktiebolaget, STAB

(Swedish Match Company); lent over $300 million dollars to

governments in Europe, Latin America, and Asia in exchange for

national match monopolies; became world's largest match

manufacturer; built small, family-owned match business into a

$600 million global match empire; owned manufacturing operations

in 36 countries, had monopolies in 16 countries, controlled 40%

of the world's match production; relied on international capital

markets to finance acquisitions and monopoly deals; 1929

- Kreuger company stocks and bonds were most widely held

securities in United States and world; 1932 -

Krueger died in Paris (suicide?); forensic auditors discovered

giant pyramid scheme; Kreuger accounts hid fictitious assets in

maze of over 400 subsidiary companies; Swedish Match's deficits

exceeded Sweden's national debt.

August 13, 1920

- Thousands of investors demanded their money back from Carlo

Ponzi. Anticipating the collapse, had already attempted to

gamble with the $2 million in a vain attempt to make up the lost

money. Ponzi went to jail and was deported to Italy in 1934. He

told reporters, "I hope the world forgives me." 1919

- told friends and potential investors that they would get a 50

percent return on their money within 90 days if they invested

with him. The hapless investors were never told much about what

Ponzi planned on doing with their money, but, when pressed, he

told them that it had to do with international postal exchange

coupons, an obscure field that virtually no one knew much about.

Paid off his initial investors and soon the investment dollars

were pouring in. Thousands of people came to his offices, where

money was stuffed in every desk drawer and filing cabinet. Ponzi

was taking in an estimated $200,000 a day at the frenzy's peak.

When a local writer questioned Ponzi's financial record, he

threatened to sue and scared off further inquiry. When state

investigators finally began examining his books and interviewing

his workers they found that there was no real investment going

on. Of course, only the very early investors actually got any

money back, and these funds came from later investors.

October 11, 1972

- Securities Exchange Commission (SEC) filed charges against

Bank of America Vice President George L. Bates and Western Oil

Development Corp.; charged Bates with "fraud and deceit" while

trading stocks of Western Oil; accused Western Oil officials of

using "fraudulent statements" to boost company's stock price (to

use as resource to "acquire valuable properties"); SEC also

convened hearings on charges of anti-fraud violations by

Continental Investments and two of its subsidiaries; stemmed

from charges that Continental Investment manipulated its

investment relationship with the United Fund group, mutual fund

company, for improper fiscal gain. Continental Investment

officials maintained their innocence, described their dealings

with United Fund group as "complex" and "technical," but not

corrupt.

August 24, 1982

- Era of unfettered greed

on Wall Street in mid-1980s. Martin Siegel

(mergers-and-acquisitions executive at Kidder, Peabody & Co.)

met Ivan Boesky at Harvard Club in New York City; agreed to give

inside information on upcoming mergers for pay; at end of 1982,

Boesky delivered $150,000 in $100 bills to Siegel at Plaza

Hotel; over next few years, Siegel passed inside information to

Boesky on several occasions (Boesky made $28 million in

Carnation stock before its takeover); Boesky's success fueled

investigative inquiries (by both press, Securities and

Exchange Commission), rumors about Siegel and Kidder, Peabody &

Co.; January 1985 - Siegel demanded $400,000

(cash drop-off was made at phone booth), decided to end the

illegal arrangement.

October 1982 -

Barry Minkow started small carpet cleaning business in mother's

garage in Los Angeles suburb; expanded into insurance

restoration company (damaged buildings); December 1986

- went public (clean audit opinions from two accounting firms,

registration statement from large Wall Street firm); reached

market capitalization of $280 million; youngest person to take

company public in Wall Street history; June 1987 -

fraud discovered - - no restoration projects, minimal revenues

relative to reported sales, no profits; July 2, 1987

- Minkow (20) resigned; January 1988 - indicted on

54 counts of racketeering, securities fraud (valued at $26

million), embezzlement, mail fraud, tax evasion; convicted,

sentenced to jail; April 1995 - released.

May 2, 1985

- E. F. Hutton & Co. pleaded guilty to charges that it had

engineered a massive check-writing swindle; lawyers admitted

that the firm had managed to soak hefty sums of money from its

various bank accounts without paying a cent of interest ( in the

neighborhood of $4 billion in checks between the summer of 1980

and February 1982); consented to pay roughly $10 million (in

fines) and restitution to the victimized banks; none of the

roughly twenty-four employees involved in the swindle faced

criminal charges.

May 28, 1986

- The U.S. Court of Appeals upheld conviction of writer R.

Foster Winans, author of the "Heard on the Street" column for

the Wall Street Journal, for securities fraud; entered scheme

with two brokers at Kidder Peabody to give them advance

information about his column; brokers, Kenneth Felis and Peter

Brant, made $700,000 by trading stocks that Winans touted in the

newspaper; Winans and his lover, David Carpenter, received only

$31,000 in kickbacks; case became public symbol of the

widespread greed, corruption, win-at-all-costs mentality of Wall

Street that prevailed in the 1980s.

November 14, 1986

- Wall Street arbitrageur Ivan Boesky pleaded guilty to insider

trading, agreed to pay $100 million fine, cooperate with

Securities and Exchange Commission's investigation; SEC called

it "Boesky Day," crucial in exposing a nationwide scandal

at heart of `80s Wall Street boom; Boesky received

three-year sentence, 22 months of which he served at Lompoc

Federal Prison in California; Congress increased penalties for

securities violations; Boesky demonized as national symbol of

greed, example of dangers of `80s-era excess; Siegel one of few

cooperative witnesses for government, virtually only one who

showed remorse for his role in fraud, got 2-month sentence,

large fine.

November 15, 1986

- The SEC fined Ivan F. Boesky $100 million for insider stock

trading.

December

18, 1987 -

Ivan F. Boesky sentenced to three

years in prison for Wall Street's largest insider-trading

scandal. served two years of his prison term, paid over $100

million in fines.

October 22, 1988 - Congress

passed bill designed to combat fiscal corruption; doubled

maximum prison term for insider trading (toughest sentence = ten

years in jail; raised ceiling on fines for insider trading up to

$1 million for individuals, $2.5 million for corporations and

partnerships; made companies responsible for improper trading

committed by their employees.

December 21, 1988 - Drexel Burnham Lambert Inc.

pleaded guilty to charges of mail, wire, and securities fraud;

agreed to hand over a record $650 million in fines, as well as

to cooperate with authorities in their ongoing investigation of

other Wall Street figures; provided evidence against Michael

Milken, junk-bond king (indicted in 1990 on nearly one hundred

counts of racketeering).

February 13, 1990

- Drexel Burnham Lambert filed for bankruptcy.

April 7, 1990

- Michael Milken pleaded innocent to security law violations;

April 24, 1990 - pleaded guilty to 6 felonies.

November 21, 1990

- U.S. District Judge Kimba Wood sentenced Michael Milken

(former Drexel Burnham junk-bond king) to a ten-year prison term

for various securities law infractions (insider trading and

"stock manipulation").

August 26, 1994

- Financier Robert Vesco

received a 13-year jail sentence in Cuba for "economic crimes

against the state." The Detroit native was found guilty of

defrauding Cuba's state-run pharmaceutical agency during the

development of TX, a plant-based "wonder drug" that was reputed

to help prevent AIDS and cancer. In the early 1970s

- he was charged with making illegal contributions to

Richard Nixon's reelection campaign for which the government

indicted him (rather than serve time, he fled to Latin America).

Vesco was also charged with trying to swindle mutual fund

investors out of $224 million.

December 6, 1994

- Orange County, CA filed for bankruptcy protection due to

investment losses of about $2 billion; single biggest bankruptcy

filing by a municipality; Orange County officials over-leveraged

county's fund, borrowed significantly for securities trading via

use of reverse repurchase agreements (investors borrow money to

buy securities, put up securities as collateral); fund suffered

losses for a year, lenders' risk increased, county forced to put

up more collateral; fund's losses rose to about $2 billion,

county officials filed for Chapter 9 bankruptcy.

February 26, 1995

- Barings PLC, Britain's oldest investment banking firm,

collapsed after one of its Singapore-based securities traders

(Nick Leeson) lost more than $1.4 billion by gambling on Tokyo

stock prices; March 2, 1995 - British trader Nick

Leeson arrested.

September 26, 1995

- Japan's 12th-largest institution, Daiwa Bank, admitted that

lax regulatory controls at a branch in New York had led to a

loss of more than $1 billion over an 11-year period; trader

Iguchi Toshihide blamed; Daiwa, Japanese bureaucrats accused of

cover-up; November 2, 1995

- Daiwa Bank's American operations closed after an investigation

revealed: 1) it had let Toshihide continue to make unauthorized

deals, even after he had racked up $1.1 billion in debt on bad

trades; 2) had worked with trader to cover up losses.

March 7, 1997

- Federal Judge Robert Sweet sentenced Steven Hoffenberg, former

chief of Towers Financial Corp., to a twenty-year prison term,

to pay out $462 million in restitution, $1 million in fines;

accused of pawning off vast sums of "worthless" Tower-backed

bonds to unsuspecting investors, conned investors out of $500

million to fund extravagant habits.

October 31, 2002

- The Securities and Exchange Commission ordered investigation

into allegations that Chairman Harvey Pitt had concealed

information on corporate ties of William Webster, his choice to

head new accounting oversight board.

November 5, 2002

- Securities and Exchange Commission Chairman Harvey Pitt

resigned under pressure after series of political missteps that

had embarrassed White House.

June 10, 2003

- ImClone chief Sam Waksal was sentenced to more than seven

years in prison in connection with stock-trading scandal.

January 24, 2008

- Societe Generale (one of Europe's biggest banks)

revealed it had lost $7.15 billion dollars at hands of a rogue

trader (Jerome Kerviel, 31); January 26, 2008 -

surrendered to the police in Paris.

Biggest Trading Losses by

'Rogue Traders

(http://graphics8.nytimes.com/images/2008/01/25/business/20080125_BANK.jpg)

(http://graphics8.nytimes.com/images/2008/01/25/business/20080125_BANK.jpg)

(Allied Irish Banks Limited), Siobhán Creaton

and Conor O'Clery (2002).

Panic at the Bank: How John Rusnak Lost AIB $691,000,000.

(Dublin, IR: Gill & Macmillan, 181 p.). Rusnak, John; Allied

Irish Banks plc.; Allfirst Bank; Floor traders (Finance)--United

States--Biography; Bank fraud--United States.

(Barings), Judith H. Rawnsley (1995).

Total Risk: Nick Leeson and the Fall of Barings Bank.

(New York, NY: HarperBusiness, 206 p.). Leeson, Nicholas

William; Barings Bank; Merchant banks--Great Britain; Bank

failures--Great Britain; Derivative securities.

_elvis.jpg) Nick

Leeson

(http://news.bbc.co.uk/olmedia/95000/images/_95940_nick_leeson_(18-05-98)_elvis.jpg)

Nick

Leeson

(http://news.bbc.co.uk/olmedia/95000/images/_95940_nick_leeson_(18-05-98)_elvis.jpg)

(Barings), Nicholas W. Leeson with Edward

Whitley (1996).

Rogue Trader: How I Brought Down Barings Bank and Shook the

Financial World. (Boston, MA: Little, Brown, 273 p.).

Barings Bank; Merchant banks--Great Britain; Bank

failures--Great Britain; Fraud investigation;

Stockbrokers--Biography.

(Barings), John Gapper and Nicholas Denton

(1996).

All That Glitters: The Fall of Barings. (London, UK:

Hamish Hamilton, 364 p.). Leeson, Nicholas William; Barings

Bank; Merchant banks -- Great Britain; Bank failures -- Great

Britain; Derivative securities.

(Barings), Stephen Fay (1996).

The Collapse of Barings. (London, UK: Richard Cohen

Books, 308 p.). Barings Bank; Bank failures -- Great Britain.

(Bell & Beckwith), Homer Brickley, Jr. (1985).

Master Manipulator. (New York, NY: American Management

Association, 161 p.). Bell & Beckwith; Securities fraud -- Ohio

-- Toledo -- Case studies; Brokers -- Malpractice -- Ohio --

Toledo -- Case studies; White collar crime investigation -- Ohio

-- Toledo -- Case studies.

(Bennett Companies), Stewart L. Weisman

(1999).

Need and Greed: The Story of the Largest Ponzi Scheme in

American History. (Syracuse, NY: Syracuse University

Press, 377 p.). Bennett, Patrick; Bennett, Michael A.; Bennett

Companies; Commercial crimes -- United States -- Case studies;

Commercial crimes -- New York (State) -- Syracuse -- Case

studies; Securities fraud -- United States -- Case studies;

Securities fraud -- New York (State) -- Syracuse -- Case

studies.

(Cassandra Group Inc.), Emily White (2007).

You Will Make Money in Your Sleep: From Boom to Bust with Dana

Giacchetto in the 1990s. (New York, NY: Scribner, 320

p.). Giacchetto, Dana; Investment advisors--United

States--Biography; Investment advisors--Corrupt

practices--United States. Former president, founder of $100 million Cassandra Group,

investment advisory firm; managing funds for celebrity clients;

charged with stealing $9.9 million in client funds, lying to

securities investigators; sentenced to nearly 5 years in prison;

won early release.

Dana

Giacchetto - Cassandra

Group

(http://news.bbc.co.uk/olmedia/860000/images/

_864406_dana_giacchetto150.jpg)

Dana

Giacchetto - Cassandra

Group

(http://news.bbc.co.uk/olmedia/860000/images/

_864406_dana_giacchetto150.jpg)

(Daiwa), oshihide Iguchi (2004). My

Billion Dollar Education. (Bedford, IN: JoNa Books, 280 p.).

Iguchi, Toshihide; Daiwa Securities; Fraud investigation;

Stockbrokers--Biography.

(Dow Jones), R. Foster Winans (1986).

Trading Secrets: Seduction and Scandal at the Wall Street

Journal. (New York, NY: St. Martin's Press, 320 p.).

Winans, R. Foster; Dow Jones & Co.; Wall Street Journal; Wall

Street; Journalists--United States; Securities fraud--New York

(State)--New York.

R. Foster Winans

(http://upload.wikimedia.org/wikipedia/en/5/5c/FosterWinans.jpg)

R. Foster Winans

(http://upload.wikimedia.org/wikipedia/en/5/5c/FosterWinans.jpg)

(Drexel Burnham), Douglas Frantz (1987).

Levine & Co.: Wall Street's Insider Trading Scandal.

(New York, NY: Holt, 370 p.). Levine, Dennis, 1952- ; Bankers --

United States -- Biography; Insider trading in securities --

United States; Investment banking -- United States -- Corrupt

practices; Investment banking -- Corrupt practices -- United

States.

Ivan Boesky

(http://s.wsj.net/public/resources/images/OB-AH938_Ivan_B_20070302100518.jpg)

Ivan Boesky

(http://s.wsj.net/public/resources/images/OB-AH938_Ivan_B_20070302100518.jpg)

(Drexel Burnham), Dennis B. Levine, with

William Hoffer (1991).

Inside Out: An Insider's Account of Wall Street. (New

York, NY: Putnam, 431 p.). Levine, Dennis, 1952- ; Insider

trading in securities -- United States; Investment banking --

United States -- Corrupt practices; Investment banking --

Corrupt practices -- United States.

(Drexel Burnham), Benjamin Stein (1992).

A License to Steal: The Untold Story of Michael Milken and the

Conspiracy to Bilk the Nation. (New York, NY: Simon &

Schuster, 219 p.). Milken, Michael; Drexel Burnham Lambert

Incorporated; Stockbrokers--United States--Biography; Junk

bonds--United States; Securities industry--Corrupt

practices--United States.

Michael Milken

(http://www.forbes.com/images/

2001/01/22/milken_168x238.jpg)

Michael Milken

(http://www.forbes.com/images/

2001/01/22/milken_168x238.jpg)

(Drexel Burnham), Mary Zey

(1993).

Banking on Fraud: Drexel, Junk Bonds, and Buyouts.

(New York, NY: Aldine de Gruyter, 306 p.). Milken, Michael;

Drexel Burnham Lambert Incorporated; Securities

industry--Corrupt practices--United States; Junk bonds--United

States.

(Drexel Burnham), Daniel R. Fischel (1995).

Payback: The Conspiracy to Destroy Michael Milken and His

Financial Revolution. (New York, NY: HarperBusiness, 332

p.). Professor of Corporate Law (University of Chicago). Milken,

Michael; Drexel Burnham Lambert Incorporated; Junk bonds--United

States; Insider trading in securities--United States.

(Equitable Life Assurance Company), Patricia

Beard (2003).

After the Ball: Gilded Age Secrets, Boardroom Betrayals, and the

Party That Ignited the Great Wall Street Scandal of 1905.

(New York, NY: HarperCollins, 402 p.). Former Writer/Editor

(Town & Country/Elle). Hyde, James Hazen, 1876-1959; Equitable

Life Insurance Company--History; Businessmen--United

States--Biography; Wall Street--History.

(Equity Funding), Raymond L. Dirks and Leonard

Gross (1974).

The Great Wall Street Scandal. (New York, NY:

McGraw-Hill, 295 p.). Equity Funding Corporation of America;

Fraud--United States; Stock exchanges--United States.

(Equity Funding), Ronald L. Soble and Robert

E. Dallos (1975).

The Impossible Dream: The Equity Funding Story, the Fraud of the

Century. (New York, NY: Putnam, 313 p.). Equity Funding

Corporation of America; Fraud--United States; Stock

exchanges--United States.

(Equity Funding), [edited by] Lee J. Seidler,

Frederick Andrews, Marc J. Epstein (1977).

The Equity Funding Papers: The Anatomy of a Fraud.

(Santa Barbara, CA: Wiley, 578 p.). Equity Funding Corporation

of America; Securities fraud--United States.

(Fisk), Willoughy Jones (1872).

The Life of James Fisk, Jr. ... Including the Great Frauds of

the Tammany Ring ... (Philadelphia, PA: Union Pub. Co.,

512 p.). Fisk, James, 1835-1872; Tammany Hall;

Businessmen--United States--Biography.

James Fisk, Jr.

(http://www.picturehistory.com/images/products/0/5/6/prod_5628.jpg)

James Fisk, Jr.

(http://www.picturehistory.com/images/products/0/5/6/prod_5628.jpg)

(Fisk), Marshall P. Stafford (1871). A Life

of James Fisk, Jr.: Being a Full and Accurate Narrative of All

the Enterprises in Which He Has Been Engaged. (New York, NY:

Pohlemus & Pearson, Printers, 311 p.). Fisk, James, 1835-1872;

Businessmen--United States--Biography.

(Fisk), Robert H. Fuller (1928).

Jubilee Jim: The Life of Colonel James Fisk, Jr. (New

York, NY: Macmillan, 566 p.). Fisk, James, 1835-1872. Erie

Railroad stock manipulator.

(Fisk), W.A. Swanberg (1959).

Jim Fisk; The Career of an Improbable Rascal. (New York,

NY: Scribner, 310 p.). Fisk, James, 1835-1872. Erie Railroad

stock manipulator.

(Frankel), J.A. Johnson, Jr. (2000).

Thief: The Bizarre Story of Fugitive Financier Martin Frankel.

(New York, NY: Lebhar-Friedman Books, 202 p.). Frankel, Martin;.

Embezzlement--United States.

Martin Frankel

(http://news.bbc.co.uk/olmedia/435000/images/_439233_frankel150.jpg)

Martin Frankel

(http://news.bbc.co.uk/olmedia/435000/images/_439233_frankel150.jpg)

(Frankel), Ellen Joan Pollock (2002).

The Pretender: How Martin Frankel Fooled the Financial World and

Led the Feds on One of the Most Publicized Manhunts in History.

(New York, NY: Simon & Schuster, 276 p.). Frankel, Martin;

Embezzlement--United States.

(Home-Stake Oil), David McClintick (1977).

Stealing from the Rich: The Home-Stake Oil Swindle. (New

York, NY: M. Evans, 335 p.). Home-Stake Production Company;

Securities fraud -- United States -- Case studies; Petroleum

industry and trade -- United States.

(IEQ Plc), David Alexander (2004).

Crooked Knight: How It All Went Wrong for IEQ. (New

York, NY: Origin of Book, 200 p.). Intermediate Equity Plc;

fraud.

(IOS), Bert Cantor (1970).

The Bernie Cornfeld Story. (New York, NY: Lyle Styuart,

320 p.). Cornfeld, Bernie, 1927-; Investors Overseas Services.

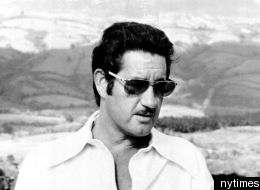

Robert Vesco

- IOC

(http://images.huffingtonpost.com/gen/20942/thumbs/s-ROBERT-VESCO-large.jpg)

Robert Vesco

- IOC

(http://images.huffingtonpost.com/gen/20942/thumbs/s-ROBERT-VESCO-large.jpg)

(IOS), Charles Raw, Bruce Page and Godfrey

Hodgson (1971).

"Do You Sincerely Want to be Rich?" The Full Story of Bernard

Cornfeld and IOS. (New York, NY: Viking Press, 400 p.).

Cornfeld, Bernie, 1927- ; Investors Overseas Services; Mutual

funds; Swindlers and swindling--Biography; Commercial

crimes--Case studies.

(IOS), Robert A. Hutchison (1974).

Vesco. (New York, NY: Praeger, 376 p.). Vesco, Robert.

(IOS), Arthur Herzog (1987).

Vesco: From Wall Street to Castro's Cuba: The Rise, Fall, and

Exile of the King of White Collar Crime. (New York, NY:

Doubleday, 380 p.). Vesco, Robert; Commercial criminals--United

States--Biography; White collar crimes--United States.

(Julian Petroleum), Jules Tygiel (1996).

The Great Los Angeles Swindle: Oil, Stocks, and Scandal During

the Roaring Twenties. (Berkeley, CA: University of

California Press, 398 p. [orig. pub. 1994]). Julian Petroleum

Corporation; Julian Petroleum Corporation; Petroleum industry

and trade--Corrupt practices--California--Los Angeles.

C. C. Julian -

Julian Petroleum

(http://jpg3.lapl.org/pics09/00024283.jpg)

C. C. Julian -

Julian Petroleum

(http://jpg3.lapl.org/pics09/00024283.jpg)

(Kidder Peabody), Joseph Jett with Sabra

Chartrand (1999).

Black and White on Wall Street: The Untold Story of the Man

Wrongly Accused of Bringing Down Kidder Peabody. (New

York, NY: Morrow, 387 p.). Government Bond Trader at Kidder,

Peabody. Jett, Joseph; Kidder, Peabody &

Co.--Employees--Biography; Insider trading in securities--United

States; Securities industry--Corrupt practices--United States.

(Kreuger & Toll), Earl Sparling (1932).

Kreuger's Billion Dollar Bubble. (New York, NY: Greenberg,

276 p.). Kreuger, Ivar, 1880-1932; Kreuger & Toll.

Ivar Kreuger

(http://wwwc.aftonbladet.se/ny heter/9812/26/KREUGER.jpg)

Ivar Kreuger

(http://wwwc.aftonbladet.se/ny heter/9812/26/KREUGER.jpg)

(Kreuger & Toll), William H. Stoneman (1932).

The Life and Death of Ivar Kreuger. (Indianapolis, IN:

Bobbs-Merrill, 280 p.). Kreuger, Ivar, 1880-1932.

(Kreuger & Toll), Manfred Georg; translated

from the German by L.M. Sieveking and Ian F.D. Morrow (1933).

The Case of Ivar Kreuger; An Adventure in Finance. (London,

UK: J. Cape, 256 p.). Kreuger, Ivar, 1880-1932.

(Kreuger & Toll), Allen Churchill (1957).

The Incredible Ivar Kreuger. (New York, NY: Rinehart,

301 p.). Kreuger, Ivar, 1880-1932.

(Krueger & Toll), Bjorn Gafvert (1979).

Kreuger, Riksbanken och Regeringen - [Kreuger, Sveriges Riksbank

and the Swedish government]. (Stockholm, Sweden: LiberForlag,

340 p.). Kreuger, Ivar, 1880-1932; Sveriges riksbank; Kreuger &

Toll; Banks and banking --Sweden; Match industry --Sweden;

International finance; Sweden --Politics and government

--1905-1950.

(Kreuger & Toll), Robedrt Shaplen (1986).

Kreuger, Genius and Swindler. (New York, NY: Garland,

251 p. (orig. pub. 1960)). Kreuger, Ivar, 1880-1932; Svenska

tändsticks AB--History; Kreuger & Toll--History; Sveriges

riksbank--History; Commercial criminals--Sweden--Biography;

Swindlers and swindling--Sweden--Biography; International

finance--Corrupt practices--History; Match industry--History.

(Krueger & Toll), Lars-Jonas Angstrom (1990). Darfor Mordades Ivar Kreuger

[The

Murder of Ivar Krueger]. (Stockholm, Sweden: Sellin & Blomquist

i samarbete med Den Svenska Marknaden, 373 p.). Kreuger, Ivar,

1880-1932; Svenska tandsticks AB --Biography; Kreuger & Toll

--History; Sveriges riksbank --History; Commercial criminals

--Sweden --Biography; Match industry --Sweden --History;

International finance --Corrupt practices --History.

(Krueger & Toll), Frank Partnoy (2009).

The Match King: Ivar Kreuger, The Financial Genius Behind a

Century of Wall Street Scandals. (New York, NY ,: Public

Affairs, 288 p.). Former investment banker (Morgan Stanley),

corporate lawyer. Kreuger, Ivar, 1880-1932; Svenska tändsticks

AB--History; Kreuger & Toll--History; Sveriges riksbank--History;

Commercial criminals--Sweden--Biography; Swindlers and

swindling--Sweden--Biography; International finance--Corrupt

practices--History; Match industry--History.

Wisdom of crowds, invisible hand, free and

unfettered market; Swedish emigre,

Ivar Kreuger, made fortune

at height of roaring 20s;

raised money in America, made loans in Europe in exchange

for matchstick monopolies; 1932 - committed suicide; had turned to shell companies in tax

havens, fudged accounting figures, off-balance-sheet accounting,

forgery; created raft of innovative financial products; millions

went bankrupt when his Wall Street empire collapsed.

(L.T.C.M.), Nicholas Dunbar (2000).

Inventing Money: The Story of Long-Term Capital Management and

the Legends Behind It. (New York, NY: Wiley, 245 p.).

British financial journalist. Long-term Capital Management

(Firm); Finance; Financial crises.

(L.T.C.M.), Roger Lowenstein (2000).

When Genius Failed: The Rise and Fall of Long-Term Capital

Management. (New York, NY: Random House. Former Wall

Street Journal Reporter. Hedge funds--United States.

(Madoff), Erin

Arvedlund (2009). Madoff:

The Man Who Stole $65 Billion. (New York, NY:

Penguin, 320 p.). Madoff, Bernard L.; Swindlers and

swindling --United States --Biography; Ponzi schemes

--United States; Commercial crimes --United States.

Bernard Madoff - Ponzi scheme (http://img.timeinc.net/time/daily/2009/0903/bernard_madoff_0310.jpg)

Bernard Madoff - Ponzi scheme (http://img.timeinc.net/time/daily/2009/0903/bernard_madoff_0310.jpg)

(Madoff), Andrew Kirtzman

(2009).

Betrayal: The Life and Lies of Bernie Madoff. (New

York, NY: Harper, 320 p.). Madoff, Bernard L.; Swindlers and

swindling --United States --Biography; Ponzi schemes --United

States; Commercial crimes --United States.

(Madoff),

Adam LeBor (2009).

The Believers: How America Fell for Bernard Madoff’s $65 Billion

Investment Scam. (London, UK: Weidenfeld & Nicolson,

312 p.). Madoff, Bernard L.; Swindlers and swindling

--United States --Biography; Ponzi schemes --United States;

Commercial crimes --United States.

Madoff's

connection to, catastrophic impact on, American Jewish

community; clubbish world where Madoff operated, links from Palm

Beach, Hamptons to salons, clubs of Manhattan society; network

of relationships; how despite material success and acclaim, some

human impulses remain eternal; how underlying sense of

insecurity shapes some of richest, most successful individuals

in America, makes them crave ever more status, peer acclaim.

(Madoff),

Jerry Oppenheimer (2009).

Madoff with the Money. (Hoboken, NJ Wiley, 272 p.). Madoff,

Bernard L.; Capitalists and financiers --United States

--Biography; Ponzi schemes --United States.

Disgraced money

manager's trail up social and economic ladder (working class

town of Laurelton, Queens to high-life on Wall Street,

super-rich enclaves of Palm Beach, French Riviera), scamming

trusting clients in $50 billion Ponzi scheme

(Madoff), Deborah and Gerald Strober (2009).

Catastrophe: The Story of Bernard L. Madoff, The Man Who

Swindled the World. (Beverly Hills, CA: Phoenix Books,

256 p.). Madoff, Bernard; Ponzi schemes--United States--History;

Scandal--Wall Street--history; crime--white collar--history.

December 2008 - FBI arrested Bernard Madoff, respected fund

manager, former chairman of NASDAQ, for reportedly bilking

thousands of trusting investors out of $50 billion; story behind

upstanding façade; how he developed elaborate deceit, how and

why he targeted, scammed world of Jewish philanthropy; used

easy-going charm, country-club sociability to gain entry into

influential circles; how he seduced, persuaded sophisticated

investors, how he eluded SEC watchdogs for years, how

far-reaching crime has affected world.

(Madoff), Harry

Markopolos (2010). No

One Would Listen: A True Financial Thriller.

(Hoboken, NJ, Wiley, 376 p.). Former Securities Industry

Executive Turned Independent Financial Fraud Investigator. Madoff,

Bernard L.; Ponzi schemes --United States. How Markopolos and

his team, "The Fox Hounds" (Frank Casey, Neil Chelo, Michael

Ocrant), uncovered (in 1998) what Madoff was doing years before

financial disaster; no one listened, until

damage of world's largest financial fraud ($65 billiobn) was

irreversible; how they discovered fraud, how they provided

credible, detailed evidence to major newspapers, Securities and

Exchange Commission (SEC) many times between 2000 and 2008

(warnings ignored repeatedly by SEC); how SEC

missed red flags raised by Markopolos; how Madoff was enabled by

investors, fiduciaries alike.

(Madoff), Diana B. Henriques (2011).

The Wizard of Lies: Bernie Madoff and the Death of Trust.

(New York, NY: Times Books, 448 p.). Reporter (New York Times).

Madoff, Bernard L.; Swindlers and swindling --United States

--Biography; Ponzi schemes --United States; Commercial crimes

--United States. Biggest Ponzi scheme in history - swindled

friends, relatives, investors out of $65 billion through fraud

that lasted for decades; Madoff's remarkable rise on Wall Street

(became one of country’s most trusted, respected traders);

accelerating slide toward self-destruction; personal disasters,

landmark legal battles triggered by Madoff’s downfall (suicides,

business failures, fractured families, shuttered charities).

(Merrill Lynch), Daniel Reingold with Jennifer

Reingold (2006).

Confessions of a Wall Street Analyst: A True Story of Inside

Information and Corruption in the Stock Market. (New

York, NY: Collins, 368 p.). Formerly World's #1 Rated Telecom

Analyst at Merrill Lynch. Investment advisors--Corrupt

practices--United States; Securities industry--Corrupt

practices--United States; Insider trading in securities--United

States; Telecommunication--Corrupt practices.

How deeply corrupted Wall Street,

and much of corporate America, had become during stock market

bubble of 1990s.

(Morgan Guaranty Trust), Gerald Astor (1975).

Hot Paper. (New York, NY: Saturday Review Press, 212

p.). Morgan Guaranty Trust Company of New York; Securities

theft--New York (State)--New York--Case studies.

Theft of $13

million in negotiable securities.

(Nomura), John E Fitzgibbon (1991).

Deceitful Practices: Nomura Securities and the Japanese Invasion

of Wall Street. (New York, NY: Carol Pub. Group, 222

p.). Nomura Shoken Kabushiki Kaisha --Corrupt practices; United

States; Securities and Exchange Commission; Securities industry

--Corrupt practices --Japan; Securities --United States.

(Orange County), Philippe Jorion, with the

assistance of Robert Roper (1995).

Big Bets Gone Bad: Derivatives and Bankruptcy in Orange County.

(San Diego, CA: Academic Press, 176 p.). Only Professor in

Orange County who teaches and researches derivatives. Citron,

Robert L.; Investment of public funds--California--Orange

County; Derivative securities; Debts, Public--California--Orange

County; Municipal bankruptcy--California--Orange County.

(Orange County), Mark Baldassare (1998).

When Government Fails: The Orange County Bankruptcy.

(Berkeley, CA: University of California, 317 p.). Senior Fellow

at the Public Policy Institute of California (PPIC) and

Professor and Chair of Urban and Regional Planning at the

University of California, Irvine. Citron, Robert L.; Investment

of public funds--California--Orange County; Derivative

securities; Debts, Public--California--Orange County; Municipal

bankruptcy--California--Orange County.

(Overend and Gurney), Geoffrey Elliott (2006).

The Mystery of Overend and Gurney: Financial Scandal in

Victorian London. (London, UK: Methuen, 288 p.). Honorary

Fellow of St Anthony's College, Oxford. Overend and Gurney;

Speculation--Case studies; Financial crises.

May 1866 - Overend and Gurney,

the City of London's leading discount house - with a turnover

second only to that of the Bank of England - suspended all

payments and provoked a 'panic without parallel in the financial

history of England'.

(Ponzi), Donald H. Dunn (1975).

Ponzi!: The Boston Swindler. (New York, NY: McGraw-Hill,

254 p.). Ponzi, Charles.

Charles Ponzi

(http://upload.wikimedia.org/wikipedia/commons/thumb/0/0a/Ponzi.jpg/150px-Ponzi.jpg)

Charles Ponzi

(http://upload.wikimedia.org/wikipedia/commons/thumb/0/0a/Ponzi.jpg/150px-Ponzi.jpg)

(Ponzi), Mitchell Zuckhoff (2005).

Ponzi's Scheme: The True Story of a Financial Legend.

(New York, NY: Random House, 390 p.). Professor of Journalism

(Boston University). Ponzi, Charles; Swindlers and

swindling--Biography; Swindlers and swindling--United

States--Biography; Ponzi schemes--United States--History;

Commercial crimes--United States--Case studies.

(Prudential-Bache, Jeffrey Taylor (1994).

The Pru-Bache Murder: The Fast Life and Grisly Death of a

Millionaire Stockbroker. (New York, NY: HarperCollins,

293 p,). Prozumenshikov, Michael, 1953-1991; Prudential-Bache

Securities, Inc.--Case studies;

Murder--Minnesota--Minneapolis--Case studies;

Stockbrokers--Malpractice--Minnesota--Minneapolis--Case studies.

(Prudential-Bache), Kurt

Eichenwald (1995).

Serpent on the Rock. (New York, NY: HarperBusiness, 480

p.). Reporter-New York Times. Prudential-Bache Securities, Inc.,

Securities Fraud.

(Prudential-Bache), Kathleen Sharp (1995).

In Good Faith. (New York, NY: St. Martin's Press, 256

p.). Prudential-Bache Securities, Inc.--Corrupt practices;

Securities fraud--United States--Case studies.

(Quintex Group), Tom Prior (1994).

Christopher Skase: Beyond the Mirage. (Melbourne, Vic.:

Wilkinson Books, 247 p.). Skase, Christopher;

Businesspeople--Australia--Biography.

Christopher Skase

- Quintex

(http://resources3.news.com.au/images/2009/06/03/1225720/656603-christopher-skase.jpg)

Christopher Skase

- Quintex

(http://resources3.news.com.au/images/2009/06/03/1225720/656603-christopher-skase.jpg)

(Quintex Group), Lawrence van der Plaat

(1996).

Too Good To Be True: Inside the Corrupt World of Christopher

Skase. (Sydney, AU: Macmillan, 388 p.). Skase,

Christopher; Businesspeople--Australia--Biography; Directors of

corporations--Australia--Biography; Fugitives from

justice--Australia--Biography.

(Rich), A. Craig Copetas (1985).

Metal Men: Marc Rich and the 10-Billion-Dollar Scam.

(New York, NY: Putnam, 224 p.). Rich, Marc; Metal trade;

Brokers; Tax evasion--United States.

Marc Rich

(http://images.forbes.com/images/2001/12/13/marc_rich.gif)

Marc Rich

(http://images.forbes.com/images/2001/12/13/marc_rich.gif)

(Salomon Brothers), Martin Mayer (1993).

Nightmare on Wall Street: Salomon Brothers and the Corruption of

the Marketplace. (New York, NY: Simon & Schuster, 272

p.). Salomon Brothers; Government securities--Marketing--Corrupt

practices--United States.

(Slater Walker Securities), Charles Raw

(1977).

A Financial Phenomenon: An Investigation of the Rise and Fall of

the Slater Walker Empire. (New York, NY: Harper & Row,

368 p.). Slater, Jim, 1929- ; Walker, Peter Edward, 1932- ;

Slater, Walker Securities, Ltd.; Capitalists and

financiers--Great Britain--Biography.

(Slater Walker Securities), Jim Slater (1977).

Return to Go: My Autobiography. (London, UK: Weidenfeld

and Nicolson, 278 p.). Slater, Jim, 1929- ; Slater, Walker

Securities Ltd.; Capitalists and financiers--Great

Britain--Biography.

(Texas Gulf Sulphur), Morton Shulman (1970).

The Billion Dollar Windfall. (New York, NY: Morrow, 239

p.). Texas Gulf Sulphur Company, inc.; Minority stockholders;

Stocks--Prices.

(TexasGulf Sulphur), Kenneth G. Patrick

(1972).

Perpetual Jeopardy: The Texas Gulf Sulphur Affair; a Chronicle

of Achievement and Misadventure. (New York, NY:

Macmillan, 363 p.). Texas Gulf Sulphur Company, inc.;

Securities--United States.

(Tipperary Joint- Stock Bank), James O'Shea

(1999).

Prince of Swindlers John Sadleir, M.P. 1813-1856.

(Dublin, IR: Geography Publications, 510 p.). Sadleir, John,

1813-1856; Swindlers and swindling --Ireland --Biography;

Legislators --Ireland --Biography. Ireland --Politics and

government --1837-1901; Tipperary (Ireland : County)

--Biography. February 16, 1856 - British member of parliament

(42), newspaper publisher, bank and railroad chairman, committed

suicide; his fraud wiped out at least three

companies, caused ruin, misery, disgrace to thousands; forged

property deeds to secure mortgages embezzled money from banks he

chaired, concealed balance sheets with false

statements.

John

Sadleir - Tipperary Joint- Stock Bank

(http://brightoncemetery.com/HistoricInterments/images/sadleirj1.jpg)

John

Sadleir - Tipperary Joint- Stock Bank

(http://brightoncemetery.com/HistoricInterments/images/sadleirj1.jpg)

(ZZZ Best), Joe Domanick (1989).

Faking It in America: Barry Minkow and the Great ZZZZ Best Scam.

(Chicago, IL: Contemporary Books, 288 p.). Minkow, Barry;

Swindlers and swindling--California--Case studies;

Corporations--Corrupt practices--California--Case studies;

Success in business--California--Case studies; Swindlers and

swindling--California--Biography.

Barry Minkow

- ZZZ Best

(http://www.pbs.org/wnet/religionandethics/week608/pics/p_feature_earlybarryminkow.jpg)

Barry Minkow

- ZZZ Best

(http://www.pbs.org/wnet/religionandethics/week608/pics/p_feature_earlybarryminkow.jpg)

(ZZZ Best), Daniel Akst (1990).

Wonder Boy: Barry Minkow, the Kid Who Swindled Wall Street.

(New York, NY: Scribner's, 280 p.). Minkow, Barry;

Businesspeople--United States--Biography; Success in

business--United States; Fraud--United States; Wall Street.

(ZZZ Best), Barry Minkow (1995).

Clean Sweep: The Inside Story of the ZZZZ Best Scam--One of Wall

Street's Biggest Scams. (Nashville, TN: Nelson

Publishers, 244 p.). Founder of ZZZ Best Co., Perpetrator of

Fraud. Minkow, Barry; Businesspeople--United States--Biography;

Christian converts--United States--Biography; Success in

business--United States; Fraud--United States; Wall Street.

(ZZZ Best), Barry Minkow (2005).

Cleaning Up: One Man's Redemptive Journey Through the Seductive

World of Corporate Crime. (Nashville, TN: Nelson

Current, 330 p.). 7 Years in Jail for Securities Fraud. Minkow,

Barry; Businessmen--United States--Biography; Swindlers and

swindling--United States--Biography; Christian converts--United

States--Biography; Fraud--United States.

Robert Smith Bader (1982).

The Great Kansas Bond Scandal. (Lawrence, KS: University

Press of Kansas, 392 p.). Securities fraud -- Kansas; Kansas --

History -- 20th century.

Donald C. Bauder (1985).

Captain Money and the Golden Girl: the J. David Affair.

(San Diego, CA: Harcourt Brace Jovanovich, 244 p.). Dominelli,

J. David; Hoover, Nancy; Securities fraud -- California,

Southern; Swindlers and swindling -- California, Southern.

Alex Berenson (2003).

The Number: How the Drive for Quarterly Earnings Corrupted Wall

Street and Corporate America. (New York, NY: Random

House, 274 p.). Business Reporter (New York Times).

Corporations--Accounting--Corrupt practices--United States;

Corporations--Accounting--Corrupt practices--United

States--Prevention; Financial statements--United

States--Auditing.

David Morier Evans (1968). Facts, Failures

& Frauds; Revelations, Financial, Mercantile, Criminal. (New

York, NY: A. M. Kelley, 727 p. [orig. pub. 1859]).

Corporations--Great Britain--Finance--Case studies; Fraud--Great

Britain--Case studies; Speculation--Case studies.

Ken Fisher, Lara W. Hoffmans (2009).

How to Smell a Rat: The Five Signs of Financial Fraud.

(Hoboken, NJ: Wiley, 207 p.). Founder, Chairman, and CEO of

Fisher Investments, 'Portfolio Strategy' Columnist (Forbes

magazine); Content Manager at Fisher Investments. Fraud

--Prevention; Commercial crimes; Investments; Swindlers and

swindling. Fraudsters often follow same basic playbook; learn

playbook, ask right questions - financial fraud easy to detect,

simple to avoid; ways to identify both intended, possible future

fraud; quick, identifiable features, red flags of potential financial

frauds; red flags.

William Flynn (1992).

Gibgate: The Untold Story. (Dublin, IR: Celtic Pub., 204

p.). Ross, George Finbarr, 1945- ; International Investments

Limited -- Corrupt practices; Securities industry -- Corrupt

practices -- Ireland; Securities fraud -- Ireland; Stockbrokers

-- Ireland -- Biography.

Diane Francis (1988).

Contrepreneurs. (Toronto, ON: Macmillan, 310 p.).

Securities fraud -- Canada; Money laundering -- Canada; White

collar crimes -- Canada.

Leslie Gould (1966).

The Manipulators. (New York, NY: D. McKay Co., 276 p.).

Speculation; Stocks; Swindlers and swindling.

Ed. Samuel L. III Hayes (1987).

Wall Street and Regulation. (Boston, MA: Harvard

Business School Press, 206 p.). Professor of Investment Banking

(Harvard Business School). Banking law -- United States;

Investments -- Law and legislation -- United States.

Michael Hellerman with Thomas C. Renner

(1977).

Wall Street Swindler. (Garden City, NY: Doubleday, 367

p.). Hellerman, Michael; Swindlers and swindling -- United

States -- Biography; Securities theft -- United States; White

collar crimes -- United States.

Sam Jaffa (1998).

Safe as Houses: The Schemers and Scams Behind Some of the

World's Greatest Financial Scandals. (New York, NY:

Robson Books, 317 p. [orig. pub. 1997]). White collar

crimes--History; Commercial crimes--History.

Lawrence Lever (1992).

The Barlow Clowes Affair. (London, UK: Macmillan, 278

p.). Clowes, Peter; Barlow Clowes (Firm); Securities fraud --

Great Britain.

Henry G. Manne (1966). Insider Trading and

the Stock Market. (New York, NY: Free Press, 274 p.).

Securities--United States.

Gene G. Marcial (1995).

Secrets of the Street: The Dark Side of Making Money.

(New York, NY: McGraw-Hill, 238 p.). Wall Street; Insider

trading in securities -- United States.

Martin Mayer (1992).

Stealing the Market: How the Giant Brokerage Firms, with Help

from the SEC, Stole the Stock Market from Investors.

(New York, NY: Basic Books, 208 p.). Stockbrokers--Corrupt

practices--United States; Securities industry--Corrupt

practices--United States; Stock exchanges--Corrupt

practices--United States; Securities fraud--United States.

Joe McGinniss (2007).

Never Enough. (New York, NY: Simon & Schuster, 358 p.).

Kissel, Nancy; Kissel, Rob, d. 2003; Murder--China--Hong

Kong--Case studies; Homicide--China--Hong Kong--Case studies;

Americans--China--Hong Kong. November 2003 - Nancy Kissel (39,

three young children) 'had it all'; charged with killing her

husband, Merrill Lynch and former Goldman Sachs investment

banker Robert Kissel, in bedroom of their luxury apartment above

Hong Kong's Victoria Harbour; 2006 - Andrew Kissel (brother),

Connecticut real estate tycoon facing prison for fraud,

embezzlement, found dead, stabbed in back in basement of his

multimillion-dollar Greenwich, CT mansion; assailant unknown.

Frank Portnoy (2003).

Infectious Greed: How Deceit and Risk Corrupted the Financial

Markets. (New York, NY: Times Books, 465 p.). Former

Derivatives Salesman at Morgan, Stanley. Securities

fraud--United States; Financial services industry--Corrupt

practices--United States; Corporations--United States--Corrupt

practices; Corporations--Auditing--United States; Fraud--United

States--Prevention.

John Lawrence Reynolds (2001).

Free Rider: How a Bay Street Kid Stole and Spent $20 Million.

(Toronto, ON: McArthur & Co., 456 p.). Holoday, Michael;

Securities fraud--Canada; Stockbrokers--Canada--Biography;

Fraude boursiere--Canada; Courtiers en valeurs

mobilieres--Canada--Biographies.

Susan P. Shapiro (1984).

Wayward Capitalists: Target of the Securities and Exchange

Commission. (New Haven, CT: Yale University Press, 227

p.). Senior Research Fellow at the American Bar Foundation. United States. Securities and Exchange Commission;

Securities fraud -- United States; White collar crime

investigation -- United States.

Gene Smith (1962).

The Life and Death of Serge Rubinstein. (Garden City,

NY: Doubleday, 284 p.). Rubinstein, Serge, 1908-1955.

Mark Stevens (1987).

The Insiders: The Truth Behind the Scandal Rocking Wall Street.

(New York, NY: Putnam, 256 p.). Insider trading in

securities--United States; Consolidation and merger of

corporations--United States; Investment Banking--United States;

Wall Street.

James B. Stewart (1991).

Den of Thieves. (New York, NY: Simon & Schuster, 493

p.). Insider trading in securities--United States; Investment

banking--Corrupt practices--United States.

David A. Vise and Steve Coll (1991).

Eagle on the Street: Based on the Pulitzer Prize-winning Account

of the SEC's Battle with Wall Street. (New York, NY:

Scribner, 395 p.). United States. Securities and Exchange

Commission--Officials and employees; Securities industry--United

States--Corrupt practices; Securities fraud--United States.

T. H. Wang; [edited by] Mark Anderson (2001).

The Economic Gang: One Man's Battle with Japan, Inc.

(Sublimity, OR: Firelight Publishing, Inc., 384 p.). Wang, T.

H.; Investments--Japan; Government--Japan.

Gary Weiss (2003).

Born To Steal: A Life Inside the Wall Street Mafia. (New

York, NY: Warner Books, 384 p.). Senior Writer (Business Week).

Pasciuto, Louis, 1973- ; Stockbrokers--New York (State)--New

York--Biography; Securities fraud--New York (State)--New York;

Wall Street; Mafia--New York (State)--New York.

--- (2006).

Wall Street Versus America: The Rampant Greed and Dishonesty

that Imperil Your Portfolio. (New York, NY: Portfolio,

320 p.). Former Reporter (Business Week). New York Stock

Exchange; Securities fraud--United States; Securities

industry--United States. Wall Street practices enable, encourage corruption, small

investor left holding bag.

_________________________________________________________________________________

Business History Links

Guide to Insider Trading: Online

Publications at the SEC

http://www.sec.gov/investor/pubs/insidertradingguide.htm

Publications about legal vs. illegal insider trading, the rules

on holding restricted stock, and rewards for tips on illegal

trading.

Virtual Museum and Archive of the SEC

and Securities History

http://www.sechistorical.org/

On the surface, the subject may not seem terribly interesting,

but the importance of providing historical materials relating to

the growth and development of the Securities and Exchange

Commission (SEC) is tremendously important. Since 1999, the

Securities and Exchange Commission Historical Society has been

collecting materials in this area, and for the past several

years it have included many of these materials on this website.

On the site, visitors can view a timeline of the SEC's history,

peruse (and listen) to a number of oral histories, and view

crucial primary documents. The "Online Programs" area is also

worth a look, as it contains full broadcasts with experts on

such topics as "Developments in the Mutual Fund Industry" and

"Transformation of Wall Street". The site is rounded out by a

photograph archive, which can be browsed alphabetically.

return to top |